Altcoin Price Prediction is back under scrutiny as selling pressure spreads across the market.

What many expected to be a February rebound has instead turned into a heavy sell-off.

BNB, Solana (SOL), and XRP have all slipped below important support levels, leaving traders unsure whether this move marks a bottom or if more downside is still ahead.

The broader picture is not comforting either.

The total crypto market cap has dropped to $2.22 trillion, down 8.55% in the last 24 hours.

The weakness is being led by Bitcoin, which has fallen 9.5% toward the $60,000 zone, while ETH is down 11.37%.

When the two largest cryptocurrencies struggle this much, pressure usually spills over into the altcoin market.

That is exactly what is playing out now.

Today, Solana has dropped 14.79% to around $79.05, BNB is down 11.26% near $618.8, and XRP has slipped 9.97% to roughly $1.29 in a single day.

With this kind of broad selling, a question is starting to surface across the market—is this the end of the current altcoin season?

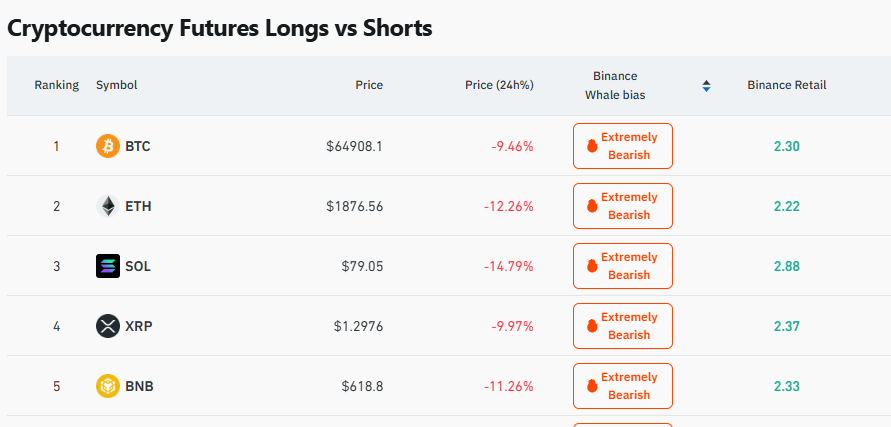

Whale Sentiment: Binance whale bias for BTC, ETH, SOL, and BNB is marked as “Extremely Bearish.” This suggests that large players are either reducing exposure or building short positions rather than buying dips.

Retail Sentiment: Binance retail ratios between 2.33 and 2.88 and 2.37 show that smaller traders are still trying to buy the dip, even as prices continue to slide.

Price Impact: The effect is already visible in price action. Solana has dropped 14.79%, while Ethereum is down 12.26%, reinforcing the idea that selling pressure is being driven by larger players.

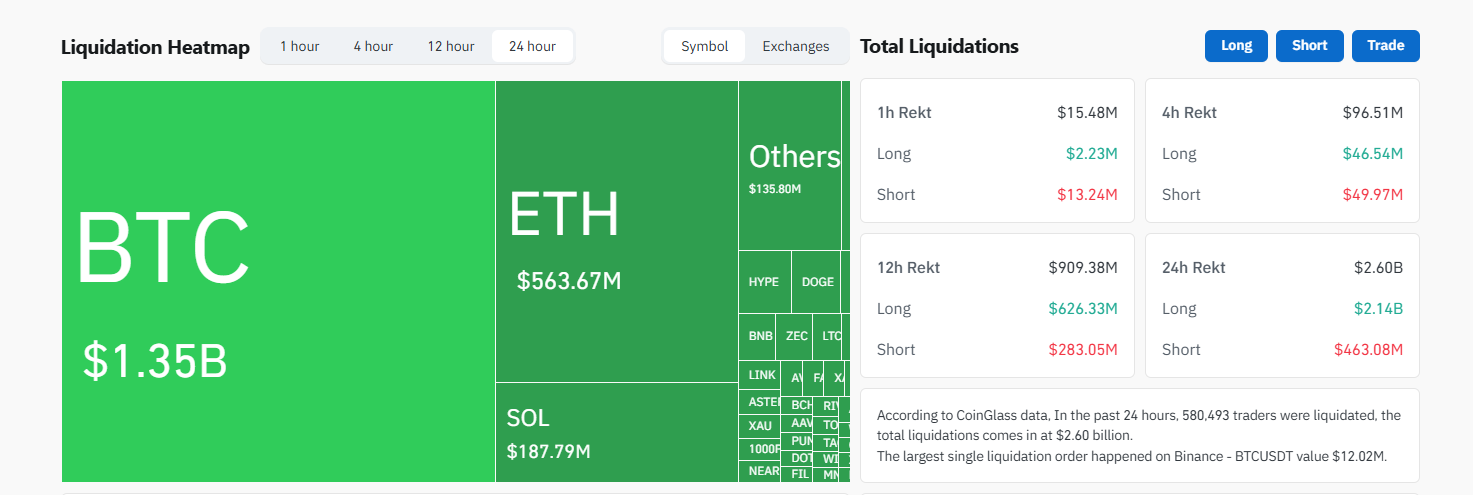

As per the recent Coinglass data, over the last 24 hours, the crypto market has witnessed a brutal liquidation cascade.

Total Liquidations: More than $2.6 billion worth of positions have been wiped out across the crypto market.

Bulls Under Pressure: Nearly 90% of these liquidations came from long positions, as traders positioned for a recovery were forced out.

BTC & ETH Impact: Bitcoin alone has seen around $1.35 billion in liquidations, while Ethereum traders lost roughly $563.67 million.

Altcoin Pain: Altcoins were not spared. Solana (SOL) and XRP have together seen close to $200 million and more in liquidations.

Why it matters: When exchanges close positions due to insufficient margin, they sell at market prices. This accelerates the decline. Until this forced selling slows down, stability in the market remains difficult.

On the 4-hour TradingView chart, BNB price was moving inside a falling channel, which has now broken on the downside.

After this breakdown, price lost the $637 key support, triggering a strong sell-off.

Although BNB bounced from the $570 level, it is now facing resistance near $637, as previous support has turned into resistance.

If price breaks below $570, the next downside level could be near $527.

On the upside, a move above $637 may open the path toward $682.

RSI is in the oversold zone, so a short-term bounce is possible.

Price is still trading below the 9 EMA, keeping the trend weak.

On the 4-hour TradingView chart, after breaking down from the $2 level, XRP price formed a bearish flag near the $1.61 zone, which has now failed.

This breakdown pushed price below the $1.41 key support, leading to a sharp drop toward $1.12, where selling pressure paused and a small bounce appeared.

Currently, XRP is facing resistance near the 9 EMA, which is acting as a short-term rejection zone.

If price moves lower from here, support could appear near $1.25, followed by $1.12 and potentially $1.00.

If XRP reclaims and sustains above the 9 EMA, the first upside resistance remains near $1.43.

On the 1-hour chart, Solana saw a bearish crossover between the 9 and 21 EMA, after which price continued to trade lower.

This move pushed SOL down to the $67.68 level, where sellers slowed and a reversal attempt started.

Currently, price is holding near the $78.94 support, while the 9 and 21 EMAs are acting as resistance, limiting upside moves.

If price turns lower again, support could appear near $67.68, followed by $51.89.

As long as price remains below the EMA cluster and no bullish crossover forms, the short-term trend may stay bearish.

Altcoin price prediction still feels uncertain rather than broken. Selling pressure has slowed, but the market does not look confident yet. Bitcoin and Ethereum remain weak, and that usually keeps altcoins under stress.

BNB, Solana, and XRP are all trading below key resistance zones, showing that buyers are hesitant to step in aggressively.

Short-term bounces can happen, especially after heavy sell-offs, but a proper recovery will likely need stronger market stability first. For now, the trend looks fragile, not finished.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.