Bitcoin Cash is now at a point where one candle can change the whole trend.

The quiet movement seen over the last 24 hours does not feel normal. It feels like the pause before a sudden move.

Today BCH has moved into an invisible line zone. In the past, this same area triggered strong sell-offs. That memory is still fresh for traders.

Right now, one question is everywhere.

Is this a real setup or a trap?

Volume is getting thinner, and liquidity is slowly drying up near this zone. Moves are smaller, but reactions are sharper. This is usually what the market looks like when traders stop trusting the move and start waiting for a trigger.

If you follow Bitcoin Cash price prediction, the story is no longer about recovery.

The story is about the next shock move.

All attention is on the critical zone for many altcoins

From here, BCH either holds its ground or reminds the market how fast fear can return.

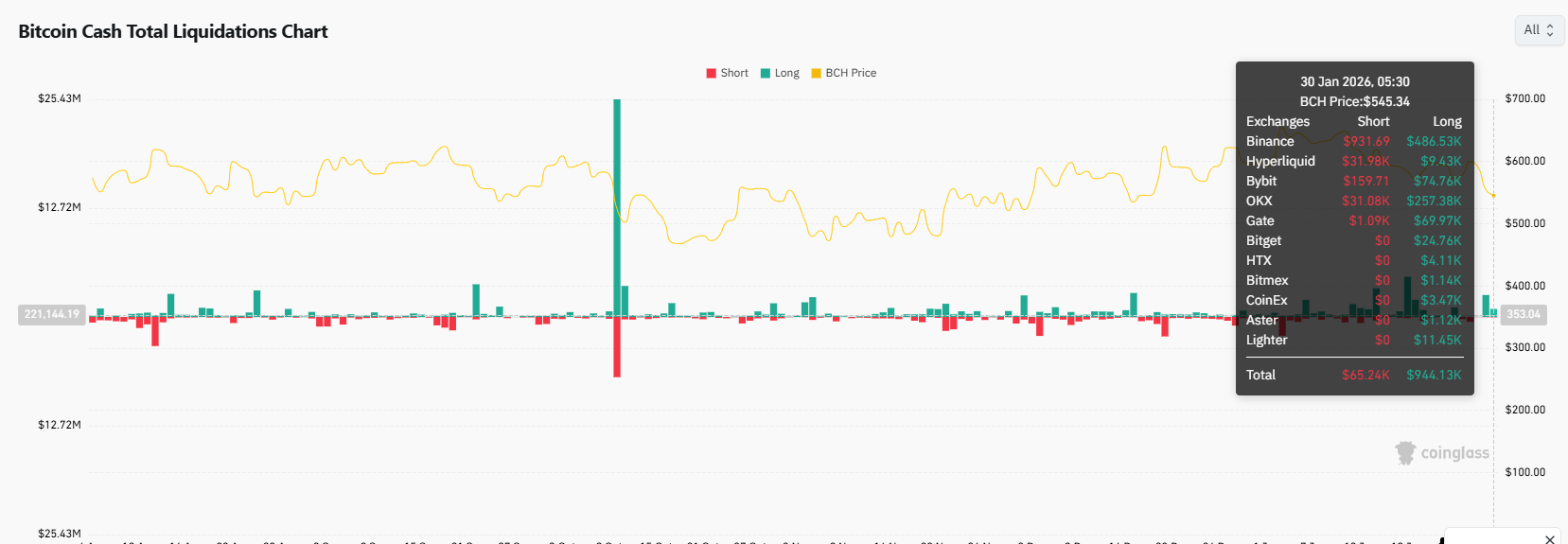

According to recent CoinGlass data, liquidation activity shows a sharp imbalance. In the last 24 hours, around $944.13K in long positions was liquidated, while only $65.24K in short positions was closed.

This gap reflects a classic long squeeze, where downside moves force buyers to exit their positions.

Instead of a normal pullback, the selling pressure increased as long traders were removed from the market.

For traders this data matters because repeated long liquidations often weaken recovery attempts. If this pattern continues, price may remain vulnerable near current levels.

On the TradingView 1-hour chart, Bitcoin Cash first moved inside a rising channel but failed to hold that pattern. After this, the 21 EMA crossed below the 50 EMA, showing a shift toward selling pressure.

The key support near $560 has now broken. Price is trading around $547, and the EMA zone above is acting as dynamic resistance. Because of this, upside remains difficult while BCH stays below these moving averages.

If selling pressure increases again, price may drift toward $520 first. Below that, the $510 area becomes the next important point to watch.

Even if price tries to move up, it is likely to face resistance again near $560.

On the daily chart, Bitcoin Cash is moving inside a falling channel.

Price is now sitting close to the lower side of this structure, where moves usually get risky and fast.

One thing that stands out is the 100 EMA. Earlier, this level was acting as resistance.

Now price is trying to stay above it, and that area is starting to behave like support. It is not strong yet, but it is important.

As long as price holds above the 100 EMA, sellers do not fully control the move.

But if price slips back inside the lower part of the channel, the structure weakens again.

If that happens, the first area to watch comes near $520 to $500. This is where price paused before.

Below that, the next zone sits around $470 to $450, where buyers stepped in during the previous drop.

For now, upside is not easy. Price is still inside a falling structure.

A clean daily close above the channel would change this view and make the downside setup less relevant.

For Bitcoin Cash price prediction, the current structure shows that the market is under pressure rather than in recovery mode.

Repeated support breaks and heavy long liquidations have reduced the strength of upside moves. As long as price stays below key resistance zones, rebound attempts may struggle to gain momentum.

If buyers fail to defend current levels, the market could remain vulnerable in the short term.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.