Is Spur Protocol ($SON) facing a temporary delay—or a serious trust test? With the listing time already passed, no exchange confirmation, and a weak crypto market, investors are asking one big question: when will the $SON Token List?

The delay has created uncertainty but also sparked intense speculation. As fear grips the broader crypto market, projects like Spur Protocol are now under a microscope. Let’s break down what this means for $SON price in the short and long term—without hype, just facts.

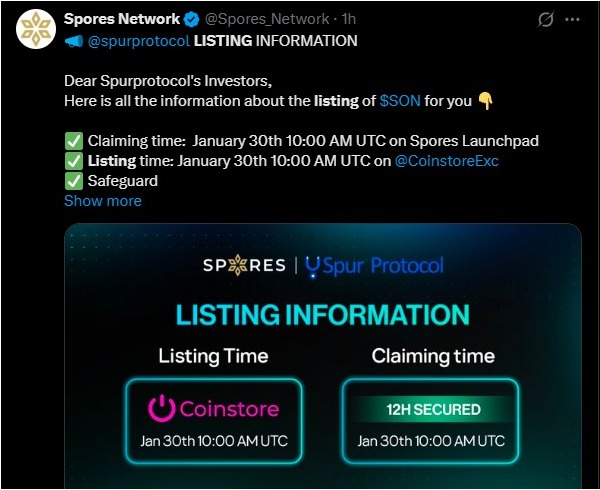

Spores Network previously shared that the Spur Protocol listing, claim, and launch were scheduled for January 30 at 10:00 AM UTC, with trading expected on Coinstore. The update also confirmed a 10% TGE unlock, followed by 10% monthly vesting, based on a $0.03 IDO price.

However, as of now, the listing time has passed, and no trading has started. More importantly, there is no official follow-up announcement from the team regarding a revised time or confirmed exchange. This silence has increased short-term uncertainty.

The broader crypto market is not helping. The total crypto market cap has dropped nearly 5.74%, falling to $2.86 trillion. Bitcoin slipped below $81,000, Ethereum dropped to $2,687, and major altcoins lost 6–12% in a single day.

The Crypto Fear & Greed Index at 16 (Extreme Fear) shows heavy deleveraging. Historically, many projects delay launch during such conditions to avoid weak launches and immediate sell-offs.

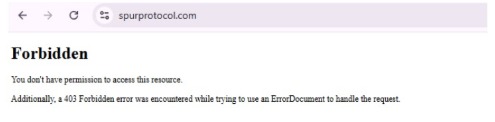

Another red flag is the 403 Forbidden error currently showing on the website. While the team has hinted at technical maintenance, extended downtime close to a TGE, and listing can hurt investor confidence.

In crypto, trust moves price faster than fundamentals. Even temporary technical issues can trigger short-term selling pressure if not communicated clearly.

Spur Protocol’s launch has been postponed multiple times—from December 19, 2025, to January 8, then January 26, and now January 30, 2026.

Projects often delay listings when less than 20–30% of tokens are sold, as low demand can lead to heavy dumping on day one. While delays are not uncommon, repeated changes without strong updates increase market skepticism.

Given the repeated delays, weak sentiment, and lack of clear communication, the token is likely to list below its $0.03 IDO price.

If the token launches without additional exchange support or a confidence-boosting announcement, the token may open between $0.018 and $0.025. Early sell pressure from airdrops and TGE unlocks could limit upside on day one.

In the short term, volatility will dominate. With a 10% TGE unlock, unclear listing details, and cautious market sentiment, $SON could trade between $0.015 and $0.028.

A strong recovery depends on official updates, stable website access, and confirmed exchange listings. Without these, sideways or downward movement is more likely.

Long term, the outlook improves if execution follows promises. Spur Protocol’s tokenomics support gradual supply release, which helps reduce long-term inflation pressure.

If the team successfully launches the Spur DEX, resolves technical issues, and secures additional exchange listings, $SON could recover toward $0.05–$0.08 in a healthier market cycle.

The project currently shows both risk signals and legitimate development signs. Launching delays, low demand, and website issues are valid concerns. However, structured vesting, migration progress, and ongoing ecosystem updates suggest the project is still active.

For now, investors should stay cautious, avoid overexposure, and wait for on-chain activity and post-listing performance before making long-term commitments.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry risk.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.