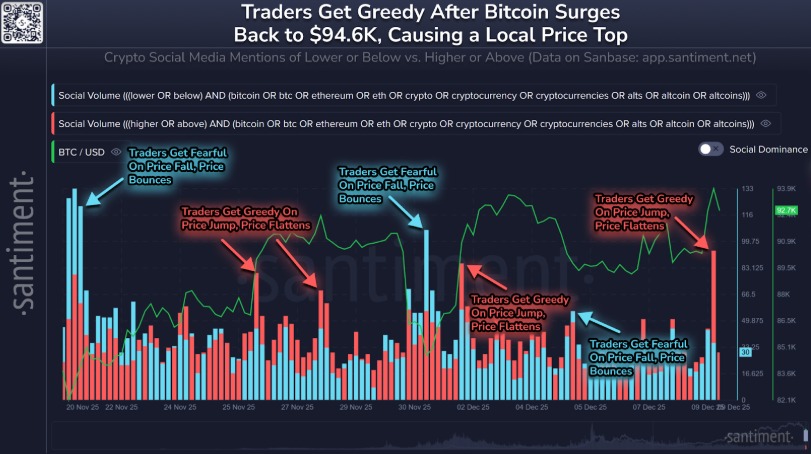

The bitcoin price pulled a fast one yesterday, ripping up to $94,600 and convincing half the market that a clean falling-wedge breakout had finally arrived. Traders didn’t just lean in infact they practically sprinted back in, fueled by December 9th’s spike in greed levels that screamed classic FOMO. And yes, that local top printed right on cue. Perfectly messy.

Here’s where things get uncomfortable. That push above the wedge border looked convincing… until it didn’t. Price is still hanging above it, but the whole move has the personality of a fakeout wearing too much cologne.

And with the FOMC meeting wrapping up today, nobody actually knows whether this thing breaks clean or snaps right back inside the pattern like it usually does.

The December upswing? A pre-FOMC ritual dance, nothing more. Rate-cut odds sat around 86%, and markets did what they always do, it priced in the good news before the Fed even opened its mouth.

Look back at past decisions and the mood deflates even quicker. Rate cuts have lined up with a weaker dollar and friendlier risk appetite, sure, but the immediate reaction has been painfully mixed. After the 25 bps cut in September 2025, price barely twitched. Another time it rallied to a four-week high, only to bleed nearly $2,000 right after and settle into boredom.

Volatility also tends to explode around these meetings. Both the September and October decisions triggered pre-FOMC pops followed by post-announcement dips. The playbook hasn’t changed: buy the rumor, sell the news… and then pretend everyone knew this would happen.

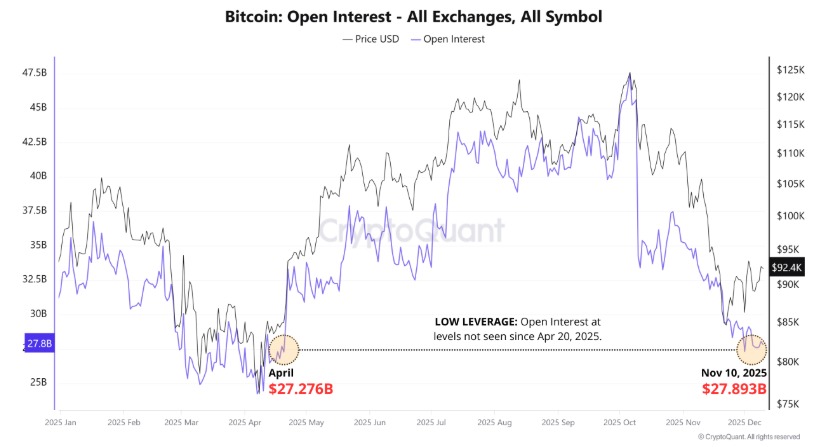

This is where things get serious. If the market does repeat its favorite pattern, then leverage and liquidity become the true puppet-masters. Elevated long funding, aggressive open interest, shifting exchange reserves, and ETF flows will tell the real story before the bitcoin/USD pair prints anything meaningful on the bitcoin price chart.

So, before anyone starts shouting about a moonshot or tossing around another confident bitcoin price prediction, it’s worth remembering that this market loves punishing certainty.

Sudeep Saxena is one of the co-founders of Coin Gabbar. Apart from developing the business, he is also a CMA by profession. Sudeep contributes to #TeamGabbar by writing geopolitical blogs.

Sudeep has an extensive experience in the crypto space and intents to build a rich knowledge bank in the form of blogs and articles, that shall develop a basic understanding of the crypto world for any new entrant in the market. When not writing, he can be found reading books.

You can connect with Sudeep on Twitter and LinkedIn.