Binance Coin (BNB) has been soaring after the announcement of VanEck filing to launch the first American-listed ETF to track BNB. Being one of the world's largest asset managers, VanEck's action could unleash new institutional demand for Coin. The question now is whether or not BNB's price can hit new highs.

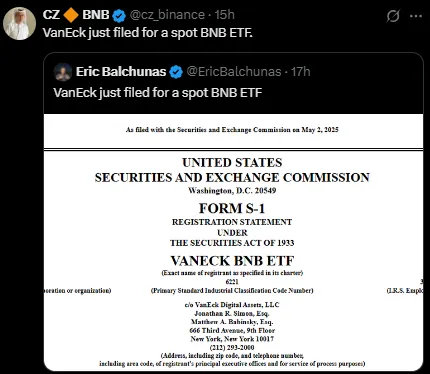

VanEck, a $116.3 billion asset manager, just filed with the SEC to list the first US-listed ETF on Binance Coin. The filing is generating massive interest in cryptocurrency that is likely to spark an uptrend in the next few weeks.

The filing is a milestone for Binance Coin, which has experienced fairly subdued price action in recent times. But with institutional demand increasing, especially through a possible ETF, the future may shift quickly. Changpeng Zhao took to X (formerly Twitter) to share the details.

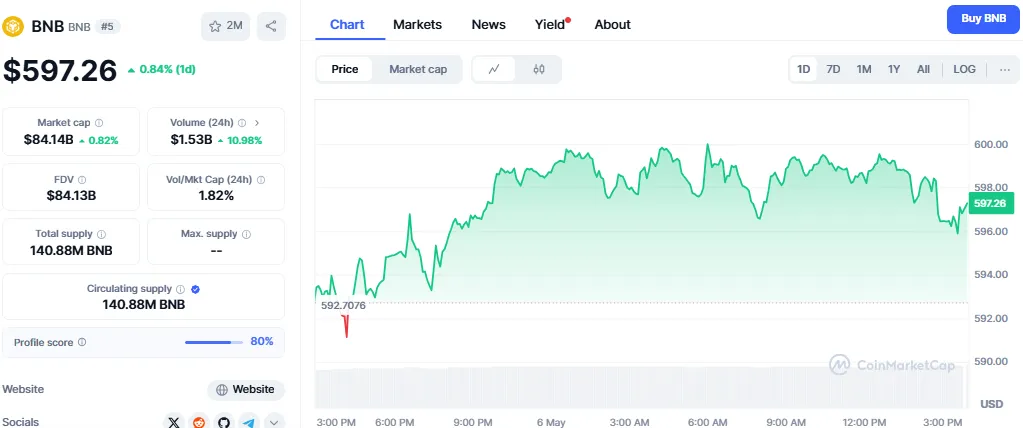

At press time, the altcoin is trading at $597.26, with a 0.85% daily increase. The altcoin has fluctuated between $591 and $600 in the last 24 hours, reflecting some stability. A closer examination of the weekly chart indicates the token is in an ascending uptrend, bouncing off a rising support line since July 2024.

Source: CoinMarketCap

The altcoin is hitting significant resistance at the $640 level. If the token breaks and closes above this level, we can expect solid momentum to the upside. In fact, the $700 level is within grasp, and if the bull market persists, some analysts have postulated that an all-time high could be tested.

Bearish Scenario: What if the Binance token does not break $640?

With that said, if the token cannot break $640 as resistance and begins to consolidate below $600, we could see a major swift retracement. If the price begins to slow below $600, prices could melt down quickly to $560 or possibly $500 as traders panic into a sell-off.

Given the recent filing, the market for the altcoin is evolving. With constant institutional demand, BNB could experience a breakout, and its price could touch the $700 level. If VanEck's ETF triggers adoption and more altcoin ETFs are accepted by the SEC, a new bull cycle could see its price increase.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.