Key Highlights:

The cryptocurrency industry experiences a 4.1% decline over 24 hours, with extreme fear dominating sentiment.

Bitcoin and Ethereum declined over 4% and 7%, while select altcoins posted short-term gains.

Major policy, ETF, and institutional adoption news shaped long-term expectations.

Overall Crypto Market Update, January 21, 2026: The cryptocurrency market fell 4.1% in the face of extreme fear, poor prices, and macroeconomic uncertainty, while institutional flows and regulatory actions remained strong indicators of long-term adoption.

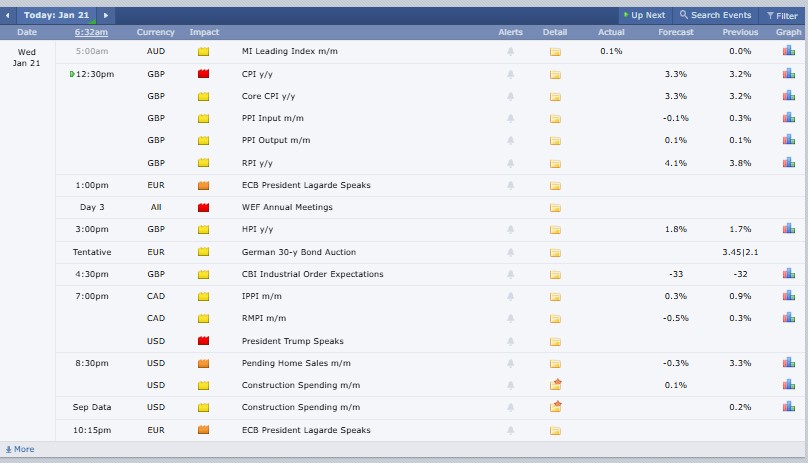

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $3.09 trillion, noted a shocking 4.1% downturn in the last 24 hours, whereas Total trading volume recorded at $158.4 billion.

Bitcoin’s (BTC) dominance over the industry remains intense with 57.5%, while Ethereum (ETH) carries 11.6%. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the past day.

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $88844.02, down 4.21% in the last 24 hours, with a trading volume of $55.71 billion and a market cap of $1.77 trillion.

Ethereum (ETH) is priced today at $2962.05, declined 7.12% in 24 hours with a trading volume of $33.7 billion and a market cap of $357.5 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

RollX price (ROLL): $0.1381, down 10.13%, trading volume (TV): $2.07B.

Bitcoin price (BTC): $88,895.90, fell 4.18%, TV: $55.64B.

Ethereum price (ETH): $2,961.14, decreased 7.27%, TV: $33.72B.

Solana price (SOL): $127.30, declines 4.97%, TV: $5.69B.

XRP price (XRP): $1.90, drops 3.73%, TV: $3.7B.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

Story price today (IP): $2.69, up 14.44%, trading activity $145.51M.

Canton price today (CC): $0.1307, up 11.10%, trading activity $29.70M.

LayerZero price today (ZRO): $1.88, up 5.57%, trading activity $116.24M.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

Monero price (XMR): $502.36, down 17.81%, with trading activity of $327.2 million.

Hyperliquid price (HYPE): $21.44, lower by 9.27%, recording trading volume of $335.2 million.

Morpho price (MORPHO): $1.16, down 9.23%, with trading activity of $27.3 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.1% negative change over the past 24 hours, with a market capitalization of $313.7 billion and trading volume of $131.8 billion.

The Overall (Defi) Decentralized Finance market dips 5.3% over the last 24 hours, recording a market cap of $105.4 billion and trading volume (TV) at $5.37 billion. Defi dominance globally marked 3.4%.

Source: Alternative Me

Today’s Fear and Greed Index is 24 (Extreme Fear), down from 32 yesterday and 48 last week, near last month’s 25. Sharp price declines, weak volumes, liquidations, and macro uncertainty increased risk aversion, pushing sentiment from neutral to panic-driven caution.

(Note: All of these updates affect traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. US Reaffirms Bitcoin Reserve Plan

At WEF Davos, Treasury Secretary Scott Bessent said President Trump backs US crypto leadership, halting Bitcoin sales and adding forfeited BTC to a growing strategic digital asset reserve plan nationwide.

2. Tom Lee Warns of Early 2026 Market Pain

3. House of Doge Plans DOGE Payments App

House of Doge is building “Such,” a new Dogecoin app launching in H1 2026, offering a self-custodial wallet and merchant tools to boost DOGE payments, with Nasdaq-listed Brag House Holdings.

4. Grayscale Moves NEAR Trust Toward ETF Listing

Grayscale has filed an S-1 with the U.S. SEC to convert its NEAR Trust shares into an ETF and list them on NYSE Arca after approval.

5. Noble to Launch EVM Network

6. Delaware Life Adds Bitcoin Exposure to Annuities

Delaware Life announced it will add BlackRock’s Bitcoin-balanced index to its fixed indexed annuities, offering indirect bitcoin exposure via IBIT while preserving principal protection and targeting 12% volatility levels today.

Compared to yesterday Crypto Update calm and range-bound session, today’s crypto market witnessed a sharp decline. The capitalization dropped from $3.22 trillion to $3.09 trillion, volumes surged, and the Fear and Greed Index slid from fear to extreme fear. Bitcoin and Ethereum shifted from near-stability to steep losses, while capital rotated away from momentum-driven altcoins, highlighting a clear transition from consolidation to panic-led selling pressure across the industry.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken onthe investment.

Based on the last 24 hours, crypto investing is risky in the short term due to sharp declines and extreme fear. However, for long-term investors, gradual accumulation during fear phases may be beneficial if managed with strict risk control.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.