Bitcoin is trading below $90,000 today, setting the tone for a risk-off session across the crypto market.

LayerZero ZRO, however, is trading around $1.95, up nearly 14.9%, with volume rising to $136.6 million, a 124% increase in activity.

At a time when the total crypto market is near $3 trillion, down about 2%, most utility and governance tokens are struggling to find support.

This sudden strength has put the LayerZero ZRO price prediction back in focus, especially as buyers step in while the broader market stays weak.

What makes this move more interesting is that it came right after a major token unlock that many expected to drag prices down

Token unlocks usually bring selling pressure, and the market was expecting the same here.

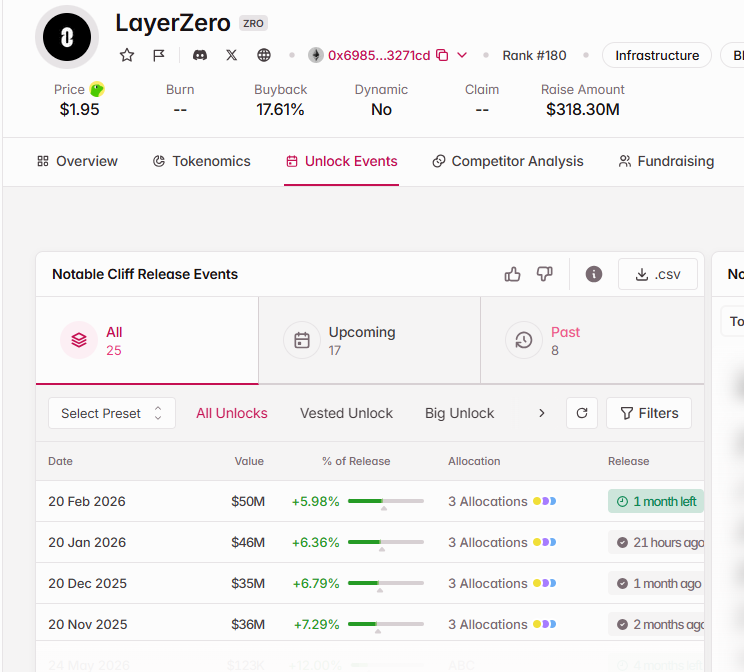

On January 20, around 25.7 million ZRO tokens, nearly 6.36% of the circulating supply, entered circulation. At the time, that supply was worth close to 45 million dollars.

Source: Tokenomist

Most of these tokens were linked to early investors and core contributors, which added to the caution. But price did not slip; instead, bullish technicals started to show up on the chart.

The new supply was absorbed. $ZRO moved higher and later rallied close to 15%. What was expected to weigh on price ended up supporting the move.

Beyond the charts, ZRO is also seeing growing real-world usage. Wyoming has launched its Frontier Stable Token (FRNT), the first U.S. state-issued stablecoin, and LayerZero is being used for its cross-chain bridging.

This kind of government-linked adoption changes how the market looks at supply events. It helps explain why the recent $45 million token unlock was absorbed rather than sold. For larger players, the focus appears to be shifting toward utility and long-term infrastructure rather than short-term price moves.

On the four-hour chart, ZRO has been moving inside a rising wedge since early 2026. Price keeps pushing higher, but the space is getting tighter. It does not look like a fresh breakout zone.

Right now, price is sitting close to the top of the wedge. It has not been rejected yet, which shows strength, but it also feels stretched. Pullbacks so far have been shallow.

Source: TradingView

The 50 EMA is still holding below price. Dips into that area have been bought quickly.

RSI is near 70, so momentum is strong but not relaxed.

Volume picked up on the last push not a thin move; it shows big player is active here.

Immediate Resistance: Price is facing supply near the $2.00–$2.08 zone, with the next resistance sitting higher around $2.25 if momentum extends.

Immediate Support: On the downside, $1.85 remains the first level to watch. A deeper pullback could bring $1.60 into focus, which marks the next demand area.

Short-Term Price Prediction: Above $1.85, price is still pushing higher. The $2.00–$2.08 area sits right ahead. If price manages to stay firm there, $2.25 comes into view next.

Invalidation: As long as price stays above $1.85 and the 50 EMA, the structure holds together. A sustained slip below this area would start to change the picture and put the wedge under pressure.

According to a recent post shared by a renowned market analyst, $ZRO is approaching a key long-term trendline that has capped price for months.

The tweet highlights that price action is now testing this area rather than moving randomly within the range.

Source: X@TheTradingTank

If ZRO manages to hold above this zone and build acceptance over time, the $3.30–$3.40 range stands out as the next major long-term reaction area mentioned in the analysis.

This is not framed as a straight target but as a zone where the market may reassess momentum.

The broader long-term view remains tied to how price behaves around this trendline, as highlighted in the analyst’s observation.

The current LayerZero price prediction stays tied to how price behaves above $1.85. Holding this base keeps pressure toward the $2.00–$2.08 zone, with $2.25 sitting higher as the next reaction area. Volume support suggests buyers are still involved. A slip below $1.85 would quickly shift attention back toward $1.60 and cool the momentum.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.