On 9 April 2025, Ethereum was trading close to the $1400 level.

Confidence was low, and expectations were muted; few imagined how quickly sentiment could change.

Over the next four months, ETH moved sharply higher and pushed back toward its previous peak range. Markets often turn when belief is weakest.

Ethereum Price Prediction 2026 is getting attention again as ETH trades close to the $2,950 level. This time, trader sentiment feels cautious.

Price is weak in the short term, and traders look unsure, this dip has slowed confidence, not caused panic.

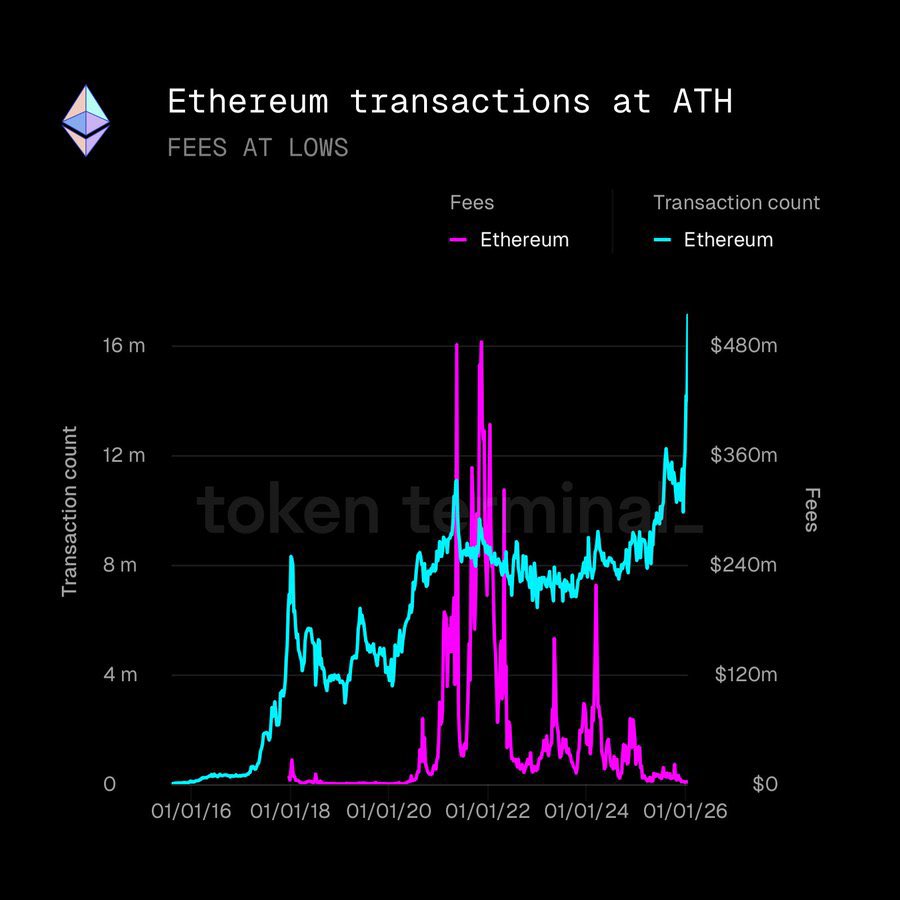

Still, the story does not end on the chart while the price cools, the Ethereum network is seeing record transaction activity. Usage is rising even as price pulls back.

This kind of gap often appears when markets reset, not when trends die. The dip looks small, but the long-term question is getting bigger.

Could this phase be preparing ETH for a move toward $10000?

Usually, when demand for a crypto asset rises, transaction fees move higher as well. Coin is behaving differently in this phase.

Recent data shows Ethereum transactions at record levels, with the network handling close to 2.9 million transactions in a single day. This move does not look random. It reflects steady improvements made to the network over time.

What stands out is the fee environment. Even with heavy usage, gas fees remain low.

This shift in gas behavior has pushed many traders to closely track fee-related data points such as ETHGas, as it reflects how network efficiency is improving beneath the price.

Activity is real, applications are running, and users are active, but costs are not rising with demand.

This unusual combination has also been highlighted by market analysts at Discover Crypto, who note that usage strength like this often appears before sentiment fully turns.

Efficiency: Network usage is higher than past bull market peaks, yet fees stay near historic lows.

Adoption: High usage with low cost points toward growing real-world adoption.

Accumulation: Strong activity with a flat price often signals quiet accumulation.

For ETH Price Prediction 2026, this gap is important. Price is still near the $2,950 level, but network activity already reflects a much stronger phase. When usage leads and price lags, sentiment often follows later.

Crypto analyst Token Talk (@TokenTalk3x) has pointed out that the price action and support reactions on the chart are drawing trader focus, underlining how these demand zones could shape short-term moves.

Price still looks heavy on the 4-hour chart, with the price stuck inside a downtrend line structure. Sellers have the upper hand for now, though the pace of selling is clearly slowing near demand.

The first zone to watch sits near $2,960–$2,940. A reaction here could push ETH back toward the $3,050–$3,120 range.

If that fails, attention shifts to the $2,920–$2,900 base, where buyers have stepped in before.

A clean move below $2,880 would change the tone and put the bounce idea on hold.

According to crypto market analyst CryptoXLARG, ETH is beginning to regain strength against Bitcoin. The ETH/BTC Supertrend has turned green, a shift not seen in years. Price is forming higher lows, pointing toward steady accumulation rather than short-term hype.

This kind of move often appears early, before broader sentiment fully adjusts.

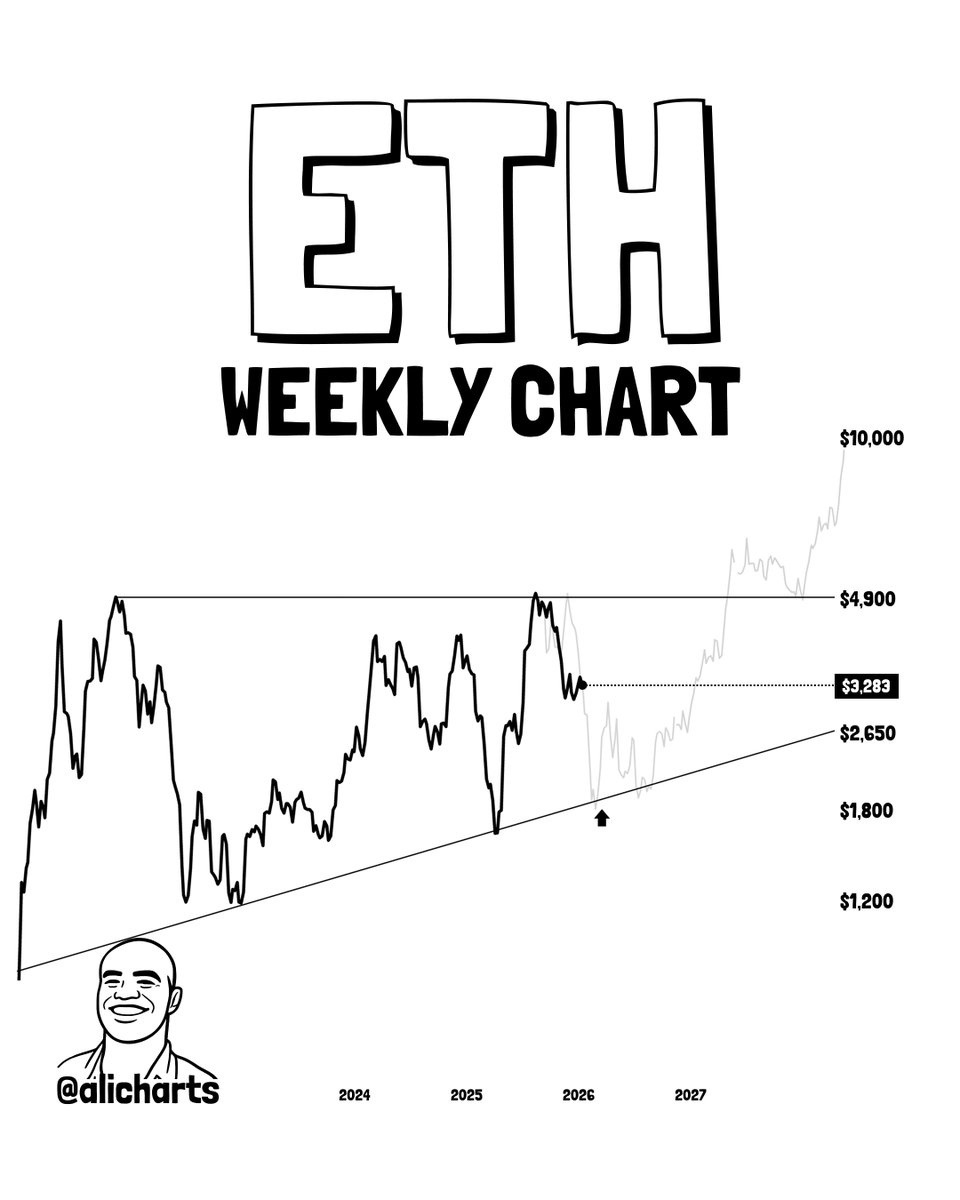

Crypto analyst Ali Martinez is looking at ETH from a weekly view, not the daily noise. The chart shows coin still moving above a long-term rising trendline, even after recent pullbacks.

His idea is simple: accumulation near $1,800 during weakness, with a long-term upside view toward the $10,000 zone if the structure holds. This is more about patience than perfect timing for ETH long-term trends.

Immediate support: $2,960–$2,940

Major support: $2,920–$2,900

Bounce zone: $3,050–$3,120

Extended upside (strong reaction): $3,150–$3,180

Invalidation: A clean break below $2,880 would weaken the short-term bounce setup.

Major accumulation zone: $1,800–$2,000

Primary resistance zone: $4,800–$5,000

Cycle expansion zone: $6,500–$7,200

Long-term upside potential: $9,000–$10,000

Invalidation: A sustained break below the long-term weekly trend support would weaken the broader bullish outlook.

For Ethereum Price Prediction 2026, many market watchers are looking past short-term price weakness. Network activity remains strong, and coin is still holding its broader weekly structure. Phases like this usually show up when the market is cooling, not falling apart. As long as key supports stay intact, experts see the longer-term trend staying open rather than capped.

YYML Disclaimer: This article is for informational purposes only and does not constitute financial advice. Crypto investments carry high market risk. Always do your own research or consult a professional advisor before investing.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.