Ethereum gas fees have never really gone away.

Sometimes they calm down, sometimes they suddenly spike, and users feel it instantly. ETHGas ($GWEI) sits right on that pressure point. It does not try to fix the problem, but it trades it.

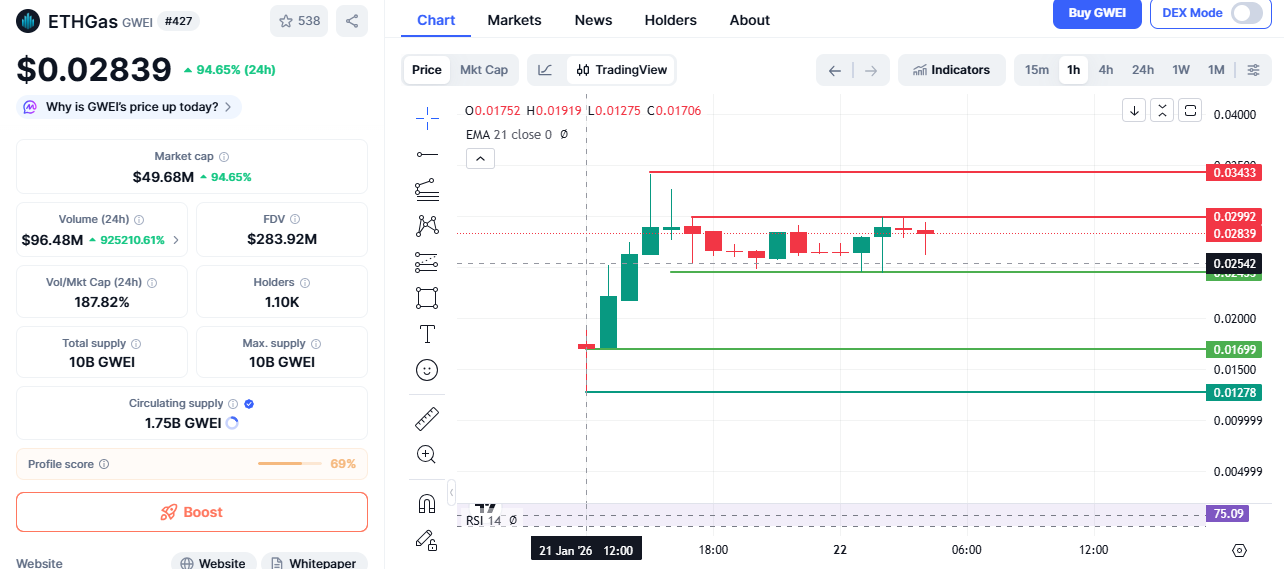

Right now, $GWEI is trading near $0.028, after a sharp 94% move in the last 24 hours. The move looks sudden, but it did not come from nowhere, which is why ETHGas Price Prediction 2026 has started drawing attention.

What stands out is not just the speed of the move but the timing.

The listing gave price a reason to react fast, and traders responded the way they usually do when liquidity suddenly opens up.

In such moments, risk perception shifts quickly, not because conviction is high, but because opportunity appears before structure settles.

The current push higher is not coming from slow adoption or long-term narratives. It is coming from visibility. GWEI token entered trader screens almost at once after listings on Binance Alpha, Bitget, and MEXC.

Liquidity showed up quickly, but sellers did not.

At the same time, the Genesis Harvest airdrop focused on wallets that had already spent significant amounts on Ethereum gas. Eligibility was tied to actual usage rather than broad participation, which pulled experienced, fee-heavy users into the market during the listing window.

Source: X@ETHGasSupport

Then comes supply.

Out of a 10 billion total supply, only about 1.75 billion tokens are circulating right now. When attention arrives faster than tokens, price tends to react first, and the thinking comes later.

Another layer traders are watching is the foundational narrative around $GWEI. The token is designed to act as a governance layer for ETHGas’s approach to Ethereum blockspace, potentially making access and execution more predictable.

This shifts part of the conversation from pure exchange reactions to *actual protocol evolution*, which some participants are pricing in now.

After the initial jump, the price did not collapse back.

That matters more than the ETHGas token pump itself.

Instead of sharp selling, $GWEI started moving in a range of $0.025-$0.030 near higher levels. Early buyers seem comfortable holding, and late buyers are unsure whether to chase or wait.

That hesitation creates balance.

Markets often pause like this when they are deciding whether the move was emotional or structural. Token is still in that decision phase.

Ignoring indicators for a moment, as per the CoinMarketCap $GWEI data, they tell enough of the story.

Immediate support sits around $0.025 to $0.026

A deeper support zone rests near $0.020 to $0.021

Near resistance shows up around $0.029 to $0.030

Above that, the $0.034 to $0.035 area becomes important

Source: CoinMarketCap

If the price holds above $0.025, the structure remains intact. A clean move above $0.035 would place price into a zone where volatility often expands.

Year | Expected Low | Expected High |

2026 | $0.021 | $0.039 |

2027 | $0.028 | $0.045 |

2030 | $0.042 | $0.075 |

2026: By 2026, token is likely to move more in response to Ethereum activity than headlines. Gas fees do not trend smoothly; they spike, disappear, then return.

If those spikes keep appearing, traders may start viewing GWEI pullbacks as pauses rather than breakdowns.

2027: As traders get used to gas-linked instruments, token participation may become more structured.

Repeated congestion phases on Ethereum could slowly push the price into higher trading ranges, especially if supply growth remains gradual.

2030: Further out, $GWEI begins to behave like a reflection of Ethereum itself. If Ethereum continues processing value at scale, gas pressure will keep coming back.

Invalidation: If price fails to hold above $0.020, the current structure starts losing strength. A sustained move below this zone would invalidate the bullish setup and signal that the recent move was largely event-driven rather than trend-building.

The path between these years is unlikely to be clean; $GWEI may go quiet for long stretches, then react sharply when network stress returns. That uneven rhythm is part of how this market moves.

Market observers tend to see token as a utility-linked speculative asset, not a simple narrative play. This is why ETHGas Price Prediction 2026 remains closely tied to actual Ethereum network activity rather than hype alone, while supply concentration continues to be a factor.

Around 27% of the supply is held by institutional players. That does not guarantee selling, but it does mean sharp moves can happen without much warning.

This keeps $GWEI interesting. It also keeps it unpredictable.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.