Is Lighter ($LIT) just the beginning of the rally or a pullback is coming next?

This question is on every trader's mind when Lighter goes up by more than 45% in one day and is traded at $3.88. Due to the strong speculation, major exchange listings, and whale activity, LIT is already considered one of the hottest new crypto tokens in the market. Let’s break the current price-driving factors and potential future directions for LIT.

The dramatic increase in price of Lighter today is a result of new demand and the overall market excitement. The whole process started with the long wait for LIT's launch and confirmed listings on KuCoin, Gate, Bitrue, and MEXC which attracted a great number of buyers.

The price went up very quickly from the low $2 range to almost $4 indicating strong buying activity. This kind of quick movement is very common when the initial investors are rushing in and the short-term traders are chasing the momentum, leading to a strong breakout.

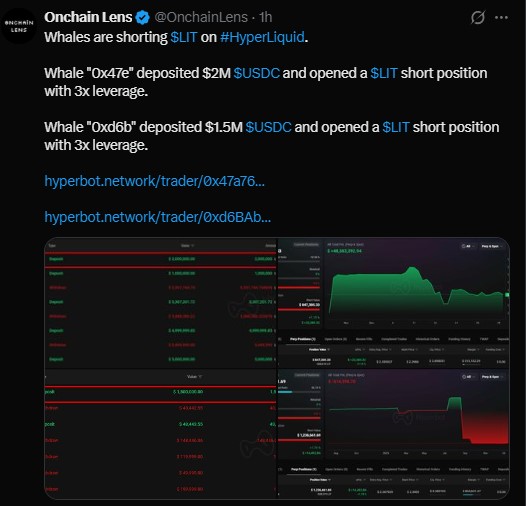

There is no doubt that retail has a strong interest in this matter; however, on-chain data is giving a mixed picture. Onchain Lens reveals that one of the whales (0x47e) has deposited $2 million in USDC to open a $LIT short position using 3x leverage and another whale (0xd6b) followed by depositing $1.5 million in USDC to open a short position similar to the one opened by the first whale with 3x leveraged.

These moves are indicative of the big institutional players who may be setting the stage for volatility or a short-term correction.

Market sentiment has mixed up as the price action is bullish while at the same time the whale activity has been bearish positioned. Therefore, we may expect a sharp price fluctuations on both sides. Traders need to be cautious since the environment is very volatile.

Lighter ($LIT) Token Supply Snapshot

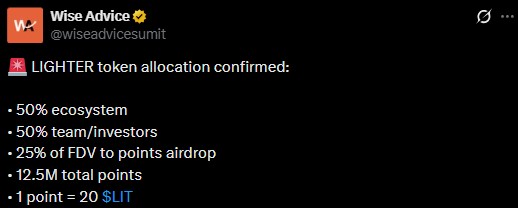

Lighter ($LIT) has a predetermined total supply of 1 billion tokens that are split into two equal parts: one for the ecosystem and the other one for the team and the investors. The whole ecosystem breaks down the other half into Power airdrops (25% spread instantaneously through Points) and the remaining for future incentives and partnerships. The 50% that is left over goes 26% to the team and 24% to the investors, both of whom are locked for one year and then gradually released over three years.

Lighter Price Prediction: Short-Term Outlook

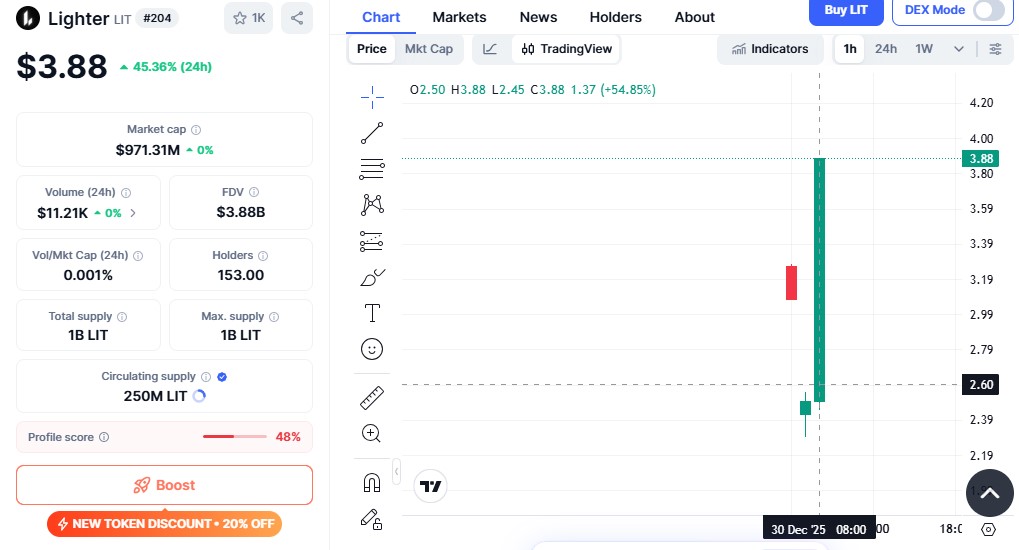

Currently as per CoinMarketCap Chart, the market cap is approximately $971 million, while the fully diluted valuation (FDV) comes to around $3.88 billion.

On the hourly chart, a powerful bullish move for Lighter ($LIT), with the token oscillating at $3.88 after a steep 43%+ rally in the last 24 hours. The price chart establishes a solid breakout candle that lifted from the low $2 area to almost $4 in no time, thus indicating strong buying power.

If the buying pressure continues to be high and the volume remains, an advance to the $4.20–$4.50 area will be a possibility. Nonetheless, considering the almost vertical move, it would be preferable for there to be a short consolidation or a pullback to the $3.40–$3.60 area before the uptrend resumes.

If the price remains above the support of $3.20, the short-term trend would be bullish.

Disclaimer: This article is for informational purposes only and not financial advice. Always do your own research before investing in crypto.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.