When the crypto market starts feeling comfortable, risk often builds quietly in the background.

Pump.fun is entering one of those moments.

Platform activity is growing, but at the same time, a supply event is approaching that traders cannot ignore.

February is shaping up to be an important test for this memecoin.

On 14 February 2026, a scheduled token unlock linked to early allocations and ecosystem distribution is set to take place.

Token unlocks matter because they add fresh supply to the market.

Even strong projects can feel pressure when new tokens become available during a sensitive phase.

This Pump.fun price prediction looks at how traders are positioning ahead of the unlock and whether the current price structure can handle the added supply.

The real risk is not the unlock itself but how price behaves if selling activity starts to outpace demand.

According to data shared by CryptoRank.io, on 14th February, nearly 10 billion tokens, worth around $21.06 million, are set to enter circulation through an upcoming PUMP token unlock.

While the dollar value may seem moderate, the scale of new supply is meaningful when compared to market liquidity and recent trading activity.

Large crypto token unlock events often increase short-term selling pressure, especially during cautious market phases.

For this memecoin, the focus now shifts to how this circulating supply expansion interacts with existing support zones and whether the market can absorb the token supply overhang without triggering excess short-term volatility.

On the 4-hour TradingView chart, price was moving inside a bearish flag pattern, which has now broken to the downside.

This breakdown confirms that the corrective structure has failed and sellers continue to control short-term price action.

After the breakdown, price is attempting to stabilize but remains structurally weak.

Price is currently trading below the 21 EMA, which is acting as immediate dynamic resistance and limiting any upside recovery.

Momentum also remains soft, with the RSI near 38, showing bearish pressure without entering extreme oversold territory.

On the downside, $0.001872 and $0.001673 are the key support levels holding price.

A sustained break below this zone could open further downside.

On the upside, resistance is stacked around $0.00217–$0.00247, and price would need to reclaim this range to ease short-term selling pressure.

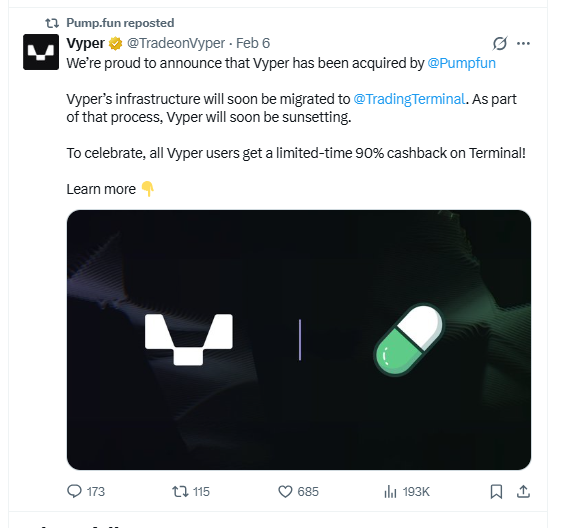

Pump.fun recently announced the acquisition of the trading terminal Vyper, with migration starting in February.

The stated goal is to shift the platform toward a more professional trading infrastructure.

However, based on recent price action, the market reaction suggests this news may have served more as exit liquidity for sellers than a genuine bullish catalyst.

The Faded Bounce: The short relief bounce that followed the announcement failed to break above the upper boundary of the prevailing structure. Instead, the move offered sellers a chance to exit at higher levels, reinforcing downside pressure rather than confirming strength.

The Valentine’s Day Overhang: With the 14 February token unlock approaching, the timing of this migration has triggered a clear sell-the-news sentiment. If nearly 10 billion PUMP tokens hit the market while the technical structure remains weak, downside continuation becomes a serious risk

Bearish Target: After the breakdown, the immediate downside target sits at $0.001673. If this level fails to hold, price could slide further toward the $0.001500 psychological support.

Resistance Zone: The $0.002174-$0.002470 zone has turned into a strong overhead barrier. As long as PUMP trades below this range, any bounce is likely to be treated as a sell-on-rise opportunity.

Invalidation: Bullish momentum would only regain strength if price manages to reclaim and sustain above $0.00250.

Pump.fun price prediction now hinges on how the market absorbs the 14 February token unlock amid an already weak short-term structure.

With supply pressure increasing and price trading below key resistance levels, downside risks remain active in the near term.

Any meaningful shift would require strong demand to counter new supply and a clear reclaim of resistance.

Until then, PUMP remains in a cautious phase where market reaction matters more than headlines.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile, and market conditions can change quickly based on macro data. It is always essential to do your own research before making any investment.

Rahul Rathore brings over 3 years of hands-on experience in technical analysis, specializing in crypto, stocks, and market trend forecasting. With a deep understanding of chart patterns, indicators, and market psychology, Rahul delivers precise, actionable insights that help traders and investors make informed decisions. His analytical approach combines technical expertise with real-world market understanding, making his content reliable and highly valued by both novice and experienced traders.