SON Token has officially entered the market with its Coinstore listing, but has the price already shown its next move?

After weeks of consolidation, the $SON price has broken down sharply, raising questions among traders and investors about what comes next.

With token claims around the corner and a clear technical breakdown on lower timeframes, the market is now at a critical turning point.

Let’s break down the SON Token price outlook in a clear and simple way.

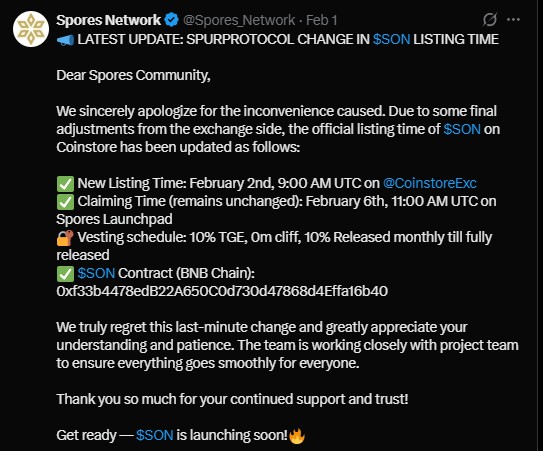

Spur Protocol was officially listed on Coinstore Exchange on February 2 at 9:00 AM UTC, marking an important milestone for the project. This listing brought fresh liquidity and trading interest to the market.

Token claiming will begin on February 6 at 11:00 AM UTC through the Spores Launchpad, and the vesting structure remains unchanged. At TGE, 10% of tokens are unlocked, with no cliff period, followed by 10% monthly releases until full vesting. This transparent schedule helps reduce uncertainty for holders.

Built on the BNB Chain, the official $SON contract address ensures full on-chain transparency and verifiability for participants.

On the 15-minute chart, price action shows a clear bearish shift. The price traded sideways for an extended period near the $0.039–$0.040 range, forming a consolidation zone.

This structure broke down after a strong bearish impulse candle pushed the price below support. The breakdown sent the token quickly toward the $0.032 level, which now acts as the nearest demand zone.

This pattern reflects a classic range distribution, where buying interest fades at the top and sellers regain control once liquidity dries up.

Momentum indicators strongly support the bearish scenario. The MACD has turned deeply negative, with expanding red histograms that show increasing downside momentum.

At the same time, the RSI has dropped into oversold territory, signaling aggressive selling pressure rather than a normal price pullback. While oversold conditions may trigger short-term bounces, they do not confirm a trend reversal on their own.

As long as SON trades below its former range support, sellers remain in control.

In the near term, the price may attempt a relief bounce toward $0.034–$0.035 due to oversold conditions. However, this move would likely remain corrective rather than bullish.

If price fails to reclaim the $0.038–$0.039 zone, bearish pressure could push toward $0.030, with a deeper move toward $0.028 if selling accelerates.

Only a strong and sustained recovery above the broken range would invalidate the bearish structure and shift momentum back in favor of buyers.

This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency investments are highly volatile. Always conduct your own research before investing.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.