Ripple USD (RLUSD) has officially launched on BitMart exchange today (Jan 28, 2026), marking another important step for its stablecoin strategy. According to the exchange, users can now:

Deposit the coins from 3:00 AM UTC

Trade RLUSD/USDT from 4:00 AM UTC

Withdraw the coins from 5:00 AM UTC

Source: BitMart Official

The BitMart listing adds to previous listings on major platforms like Binance and Kraken, improving overall liquidity.

However, it has to be noted that the trading is restricted in Lithuania due to regulatory rules.

The launch gives broader access to the stablecoin for both retail and institutional users, while strengthening the payment-focused ecosystem, but can it stabilize the staggering value of the stablecoin? And why is it being compared to XRPs?

RLUSD is USD-denominated stablecoin issued by Standard Custody & Trust Company, a fully owned Ripple subsidiary. Each token is backed 1:1 by U.S. dollars and cash equivalents, focusing on trust, liquidity, and regulatory compliance.

According to market data, the RLUSD coin is currently hovering around $0.9992, with around $117-$120 million in 24-hour trading volume and 1.33 billion in market cap.

To strengthen the stablecoin's real world use more, the platform has already integrated it into several enterprise products. These include Ripple-Payments, institutional treasury tools, and DeFi integrations across both the XRP Ledger and Ethereum.

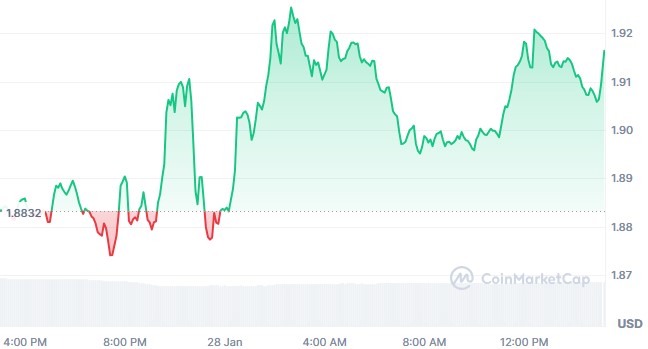

On the other side, XRP, Ripple’s blockchain native crypto token, sustained price strength in broader markets leaving Bitcoin and Ethereum in recent growths. Currently trading at $1.90, with $2.27 billion in around the clock trading volume and $116.06 billion in market cap.

Source: CoinMarketCap Data

Growth in the price is majorly seen due to the recent DXC Technology partnership, $9.16 million in spot XRP ETFs while others saw outflows, and a most hyped news which expected Japan to consider the crypto token as a regulated financial asset.

The mass attention on the platform’s crypto coin is shaping user narratives around RLUSD versus XRP.

Many investors compare RLUSDs and XRPs, but the two assets serve different purposes.

Ripple USD stablecoin: Designed for price stability, payments, remittances, treasury management, and settlements.

XRP: Acts as a bridge asset, enabling fast and low-cost currency conversions across borders.

In simple terms, the USD-backed coin provides stability, while XRPs provide speed and liquidity. Ripple uses a dual-asset strategy where RLUSD handles USD-based transfers, and XRP supports multi-currency flows when converting between different fiat or stablecoins.

This approach reduces volatility risks for institutions while keeping XRPs essential for cross-border liquidity.

As the coin is stable in nature, its success depends on usage in payments, DeFi, and institutional finance. Taking that, the network has already been working on it diligently.

Key developments include:

Multichain expansion for broader DeFi access

Chainlink price feeds for transparency

Institutional adoption, including using the stablecoin as collateral

Regulatory approvals in regions like Singapore, UAE, and New York

And now as BitMart also supports the vision of building real utility, adoption seems to grow steadily. With RLUSD bringing stability and XRP enabling fast global transfers, Ripple’s ecosystem continues to mature in 2026.

Disclaimer: This article is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are volatile—always do your own research before investing.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.