Could a single exchange decision shake investor trust overnight? "The Spur Protocol delisting request has sent shockwaves across the crypto community after the SON price crashed sharply and the project suspended major activities."

What began as a promising listing quickly turned into a high-stress situation involving manipulation claims, refunds, and halted distributions.

Momentum initially built when $SON listed on CoinStore on February 2, 2026, at 9:00 AM UTC. Despite modest presale traction, the launch showed steady demand. Soon after, the airdrop claim started on February 6 at 11:00 AM UTC (4:30 PM IST) through the official launchpad, where users connected supported wallets and completed the guided process to receive tokens.

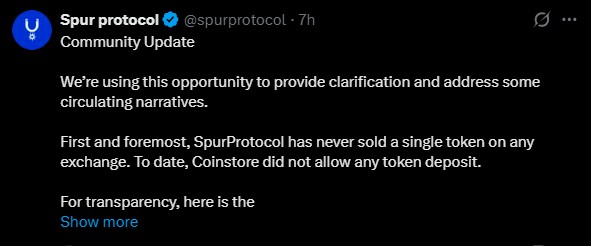

However, the narrative changed dramatically following the team’s clarification update — now widely discussed as major Spur protocol delisting news.

In its latest statement, the team stressed that the project has never sold a single token on any exchange, adding that CoinStore had not allowed token deposits so far. For transparency, the project shared the updated contract address: 0xf33b4478edB22A650C0d730d47868d4Effa16b40.

Source: Spur Protocol X Account

Blockchain verification reportedly shows that the only holders are:

CoinStore

Market-making wallets

Launchpad partnership wallets (one partner operates three wallets)

A test wallet used for staking contract testing

The team alleged that recent market activities and manipulations were handled by CoinStore without authorization, including irregular actions involving unlawful USDT deductions from a market-making account.

As a result, the project confirmed it will formally request Spur Protocol delisting today from the exchange. Going forward, all new exchange listings and Spur protocol airdrop distributions are suspended indefinitely while advisers review the situation.

“The Huostarter soon announced a full 100% refund for all IDO subscribers, reinforcing concerns surrounding the $SON delisting from CoinStore today narrative.”

Source: Huostarter X Account

According to the platform:

50,000 USDT had been subscribed for the IDO.

Trading began on February 2, while community deposits were scheduled for February 6.

The token price declined even before deposits opened.

The platform stated that suspicious centralized exchange activity triggered the cancellation. Coingabbar's research states that investors also noticed that the exchange was not allowing users to view the asset’s trade history, which had previously been visible before the alleged manipulation.

The SON price crash became evident on the SON/USDT 1-hour chart. The token now trades near $0.01500, marking a steep -21.01% decline. Technical indicators underline the weakness:

MA(5): $0.01920

MA(10): $0.01908

MA(30): $0.03111

All moving averages sit above the current price, signaling bearish momentum. Volume surge suggests panic selling or forced liquidations rather than normal exits.

Meanwhile, the MACD remains negative (-0.00054), confirming continued downward pressure. Analysts interpret this as a trust-driven selloff rather than a routine correction.

Market experts say, transparency gaps, restricted trading data, and sudden operational pauses often surge fear in early-stage tokens— a pattern visible in this token's update.

The Spur Protocol delisting date February 7 story highlights how fast sentiment can shift in crypto markets. With refunds underway, airdrops halted, and listings frozen, uncertainty remains high. Until clearer exchange outcomes and operational updates emerge, SON may face continued volatility, making investor caution essential during this developing situation.

YMYL Disclaimer: This article is strictly for informational purposes only and does not provide any financial advice. Cryptocurrency investments carry high risk, so it's always better to verify the information with official sources and do your own research before investing.

Sara Sethiya is an experienced crypto journalist with five years of experience in blockchain research, price movements, and market analysis. With a background in mass communication and journalism, she specializes in data-driven news articles, in-depth market reports, and SEO-optimized content. As a team lead and content writer at CoinGabbar, she examines on-chain metrics, evaluates liquidity trends, and analyzes tokenomics to uncover market patterns. Her analytical approach helps traders and investors interpret market shifts, identify potential opportunities, and understand the broader impact of blockchain innovations on the financial ecosystem.