The DeFi sector has been hit once again, this time with a major USPD Exploit that resulted in unauthorized minting, drained liquidity, and an estimate of over $1 million stolen protocol funds. The attack has shaken users across the ecosystem, raising fresh concerns about security after a long string of 2025 crypto thefts.

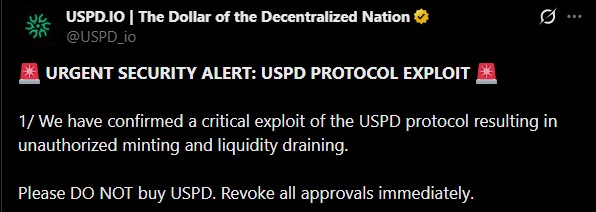

The Stablecoin protocol team confirmed the highly sophisticated breach early on December 5, urging users to avoid buying USPD and revoke all approvals immediately due to the ongoing security breach.

Now the question arises is it so easy to hack a protocol network and not then how USPD exploit happens and why it's called highly sophisticated? Is any other dark side method approaching virtual spaces?

According to the official statements, the attackers used a rare, advanced technique known as a CPIMP (Clandestine Proxy in the Middle of Proxy) exploit, making this one of the most complex crypto-hack news stories of the year.

The team clarified that the event was not caused by faulty contract logic or initial breach. In fact, the protocol had undergone full audits by Nethermind and Resonance. Instead, the attacker manipulated the deployment process in September using a Multicall3 transaction to seize admin control before the official initialization.

To hide their tracks, the attacker installed a shadow implementation contract, cleverly forwarding calls to the real audited code. By manipulating event logs and storage slots, they even fooled Etherscan into showing the legitimate implementation.

This stealth operation went undetected for months before the attacker upgraded the proxy and minted nearly 98 million USPD tokens, leading to the protocol's fund stolen and liquidity drained across pools.

Following the USPD account hacked alert, the team contacted exchanges and law enforcement, flagging the attacker’s wallets to prevent further movement of stolen assets.

In an unusual step, the platfoem offered the attacker a 10% bug bounty if they returned 90% of the funds, an approach increasingly used in large-scale DeFi incidents.

The USPD Exploit news comes during what analysts now call one of the worst months for digital-asset security in 2025.

CertiK data shows November alone saw more than $172 million in crypto losses, even after partial recoveries. The biggest hits included:

Balancer – $113M exploit

Upbit – $29.8M hack

Bex – $12.4M exploit

Beets – $3.8M exploit

In multiple cases, attackers used not just smart-contract weaknesses but private-key theft, price manipulation strategies, and phishing campaigns.

The Upbit Solana hack, the Yearn yETH vault breach, and even malware that silently siphoned tiny amounts of SOL all highlight how fast-evolving attackers are becoming.

What makes the $1 million theft particularly alarming is not the amount – it’s the method.

This USPD exploit did not rely on a contract bug, poor logic, or a liquidity loophole. Instead, it compromised the proxy layer during deployment, suggesting attackers are moving to more “invisible,” infrastructure-level strategies.

For DeFi builders, this signals a shift:

Even audited, secure smart contracts may be vulnerable at the proxy and deployment level.

Bottom Line

As authorities investigate and the network team prepares a full technical report, the incident will likely become a key case study in 2025 crypto thefts—and a turning point in how protocols protect themselves from unseen deployment vulnerabilities.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.