Why is Crypto Crashing Today when markets were so positive just a few days ago? This is the question being asked by investors, who are seeing prices fall across top cryptocurrencies. The global cryptocurrency market cap, according to data from CoinGecko, is currently at $3.23 trillion, down 2.5% in the last 24 hours. The trade volume is at $124 billion, indicating heavy trade activity during the fall. The Bitcoin dominance is at 57.5%, while Ethereum dominance is at 12%. The Bitcoin price are down 2.2% at $93,004.43, while Ethereum is down 3.1% at $3,218. XRP is down 3.9%, while Solana is down 6.1%.

This sharp drop is like a wave of fear in the crypto market after it has been performing well. The story here is about politics, regulations, leverage, and institutional investors acting in response to pressure.

The reason for the weakness in the market is the trade war concerns that are prevailing in the current market. Experts explain that the capital flow has shifted to safe assets such as gold and silver due to the threats by U.S. President Donald Trump to the EU nations with regard to imposing tariffs. The nations that are mentioned in the threats include Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland.

Source: The Kobeissi Letter

The tariffs will begin at 10% from February 1st and increase to 25% by June if there are no agreements. The European Commission refers to this as "blackmail" and is lining up its own tariffs of $101.4 Billion (€93 billion) against U.S. exports.

History illustrates that these tensions have harmed risk assets in the past. During the U.S.-China tariff dispute last year, Bitcoin decreased by almost 25%, and the worldwide market cap decreased by 32% to $2.96 trillion.

Although today’s decline is not as severe, a lack of resolution can create a compounding effect that can cause a further decline.

Second reason for why is Crypto Crashing Today is a lack of progress in crypto regulation in the U.S. The Senate Banking Committee has pushed back its markup of the CLARITY Act. This is after a withdrawal of support for the bill by Brian Armstrong, the CEO of Coinbase.

However, the U.S. Supreme Court justices questioned the constitutionality of Trump’s tariff powers as well. The matter is pending in court as of the moment. These two developments make investors less willing to take on risks due to the uncertainties surrounding these two matters.

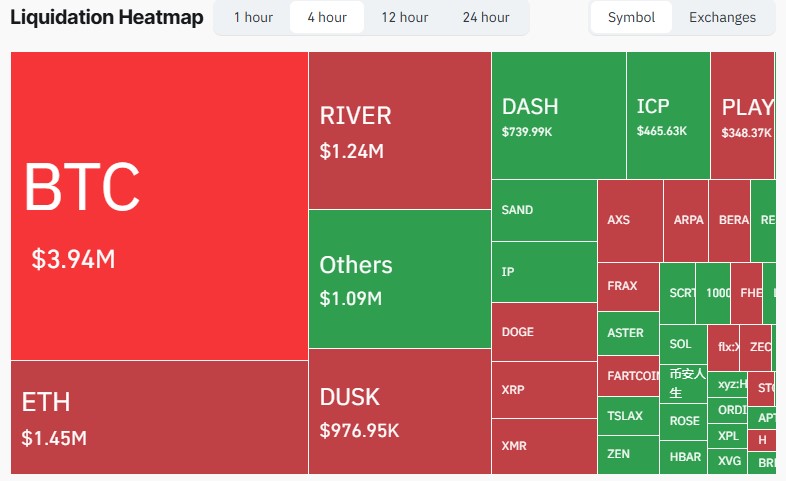

Leverage contributed significantly to what happened today. According to data from CoinGlass, 248,203 traders were liquidated in 24 hours, with a total of $874.80 million being liquidated. The largest single order was in Hyperliquid: BTC-USDT, with $25.83 million.

Source: CoinGlass Data

Whale activities also represent fear. Lookonchain found that whale 0x10ea's 113M DOGE long position worth 14.56M USD was completely unwound, resulting in a 2.7M USD loss. Whale Ci8jH5 withdrew 20,466 SOL but reinvested 20,466 SOL back into Kraken after its value depreciated from 4.1M USD to 2.83M USD, thus actualizing its 1.27M USD loss. Such panic selling leads to an increase in supply and further reduces prices.

Market emotion mirrors this change. The Crypto Fear and Greed Index fell to 44, entering the “Fear” area.

Why is Crypto Crashing Today may seem alarming, but it is important to note that this is merely a correction in the wake of a strong rally. Experts like Arthur Hayes, Tom Lee, and Robert Kiyosaki are also predicting a strong bullish cycle in the coming years of 2026.

Why is Crypto Crashing Today has to do with trade anxieties, regulatory slowdowns, forced sales, and whale panic. These factors are undermining confidence, not undermining fundamentals. The market is adjusting, not imploding. If past trends repeat, this correction may lay the foundation for the next major bullish cycle.

YMYL Disclaimer: This article is strictly informational in nature and does not constitute an investment recommendation. Investment in cryptocurrencies is extremely volatile. It is always essential to do your own research before making any investment.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.