Why is Crypto Crashing Today? This is the question many traders are asking as digital assets face one of the fastest declines seen in recent months. In just 22 days, nearly $1 trillion vanished from valuations, creating panic across the ecosystem.

According to CoinMarketCap, total valuation fell over 8.77% intraday to about $2.23 trillion. Over the past month, it slid from $3.30 trillion to $2.17 trillion, showing how fast sentiment can flip.

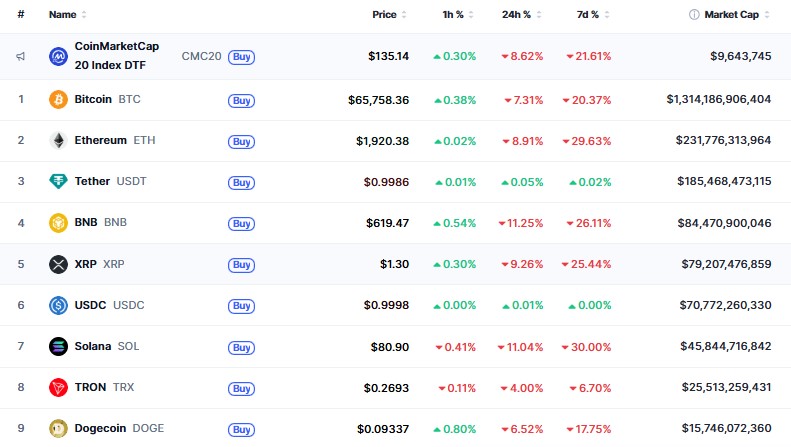

Bitcoin price dropped more than 9%, touching $60K before stabilizing near $65,155.77 with a $1.3T valuation. Ether declined over 12% to $1,891.41, Solana fell 14% to $79.43, while Dogecoin lost 11.36% to $0.09091.

Source: CoinMarketCap Data

Liquidations reached $1.82B, with 90% long positions wiped out, marking the biggest one-day fall since the FTX era.

Trump Tariffs Shock Traders: Political uncertainty often drives risk-off behavior. Recent debates tied to Trump Tariffs and policy meetings sent strong signals across capital markets.

Even though crypto-friendly leadership nominations for the SEC created optimism earlier, investors appear focused on macro risks instead. Sudden regulatory or trade changes typically push funds toward safer assets, explaining part of why is Bitcoin dropping alongside the broader crypto market crash.

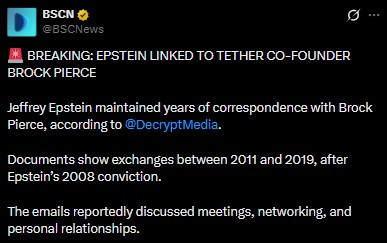

Epstein Files Raise Market Anxiety: Fresh discussions around epstein files crypto connections added another layer of fear. Reports referencing figures such as Satoshi Nakamoto and Brock Pierce triggered speculation, even though no new charges were announced.

Source: BSCN X

When reputational concerns surface, institutions often step back temporarily. This hesitation can reduce liquidity and deepen price swings.

US Shutdown Pressure Hits Risk Assets: A partial US Government Shutdown 2026 began after Congress missed the January 30 funding deadline. Historically, shutdowns weaken investor confidence because they signal political gridlock.

Risk-heavy sectors usually react first, and the ongoing uncertainty appears to be accelerating the crypto market crash narrative.

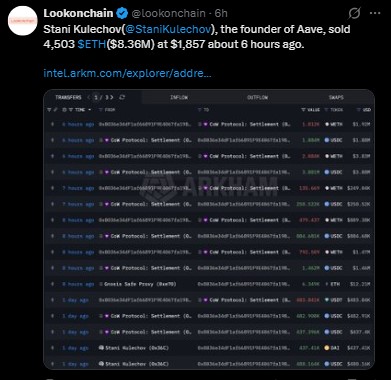

Whale Selling Moves Add to Panic: Large transfers amplified this situation. Data from Lookonchain shows wallets linked to Konstantin Lomashuk sending 12,458 stETH ($23.76M) and 2,566 ETH ($5.38M) to Wintermute. Meanwhile, Aave founder Stani Kulechov reportedly sold 4,503 ETH ($8.36M) near $1,857. Such moves often trigger copy-selling among retail traders.

Source: Lookonchain Data

Fear and Greed Index Signals Extreme Panic: The fear and greed index now reads:

Now: 9 (Extreme Fear)

Yesterday: 12 (Extreme Fear)

Last Week: 16 (Extreme Fear)

Last Month: 42 (Fear)

Persistent low readings highlight deep caution across the sector.

Many investors still see opportunity. Robert Kiyosaki on Bitcoin commentary suggests patience until new bottoms appear. In an X post, he stated that profits are made during buying phases, not selling.

Source: Robert Kiyosaki

CoinGabbar analysts believe recovery may take time because several macro events collided at once—but history shows digital assets often rebound after panic-driven exits.

So, Why is Crypto Crashing Today? A rare mix of tariffs debate, Epstein-linked headlines, shutdown fears, whale selling, and extreme sentiment created the perfect storm. Recovery may not be instant, yet cycles show stabilization usually follows panic. Careful observation, disciplined strategy, and patience remain essential in volatile environments.

YMYL Disclaimer: This content is for educational purposes only and should not be considered financial advice. Digital assets are highly volatile. Always conduct independent research and consult a financial advisor before making investment decisions.

Deepmala Upadhyay is an experienced crypto journalist, content strategist, and News writer with over 5 years of expertise in writing and the crypto industry. Holding a Bachelor's Degree in Computer Science and a deep understanding of blockchain technology and financial markets, she excels in delivering exclusive news, in-depth research blogs, and expertly crafted on-page SEO content. As a team lead and content writer at CoinGabbar, Deepmala is responsible for analyzing blockchain technologies, cryptocurrency, price movements, and the crypto market with precision and insight. Her keen ability to create well-researched, impactful content, combined with her expertise in market analysis, makes her a trusted voice in the crypto space.