With an impressive token launch followed by airdrop which was very much talked about, LIT immediately attracted new holders and liquidity. However, after the first thrill wore off, the price movement became picky.

This leads to a very important query for all the market participants: Has the Lighter price dropped too much or the market is still considering the risk of the future?

The Lighter price prediction 2026 analysis will tell you what is really important—on-chain activity, token supply pressure, market sentiment and short-term technical signals—and in return will give you a clear and realistic outlook.

The strong start of LIT gave rise to a great price increase and it reached a post-launch high of $2.85 before undergoing a correction which can be considered as healthy. The price fell back to about $2.31 which is almost a 19% decrease.

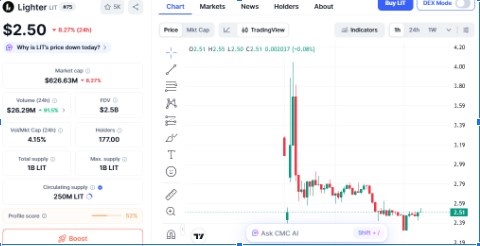

The current price of LIT is around $2.50, which is 8.27% lower than in the previous 24 hours, indicating that the market is still volatile, but there is a stable demand at the lower price levels.

Even though the market movements are contrary to this pullback, the fundamentals of the market still indicate a more neutral situation in the long term.

According to the blockchain data, Jump Crypto started its market-making activities on Lighter during mid-November, and the company was allocated approximately 9.285 million LIT tokens, which were around $24.2 million or 0.93% of the overall supply at that time, in return.

The movement of tokens to the wallets that were recently created as well as the addresses that were connected with Jump indicates that these tokens were given away as market-making rewards in order to enhance liquidity on the platform.

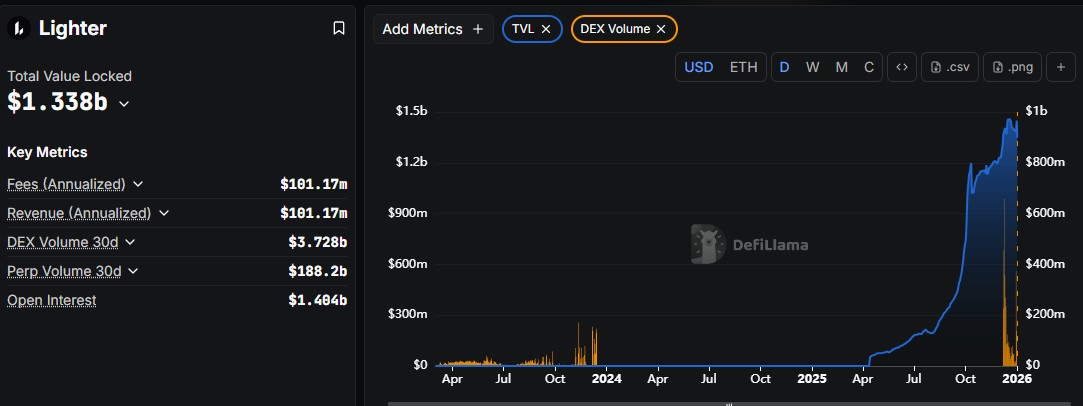

At the beginning of 2026, Lighter exhibited a very strong capital efficiency:

MarketCap: $626.27 million

Total Value Locked (TVL): $1.338 billion

TVL-to-Market Cap Ratio: 2.14

This indicates that Lighter has more than doubled the capital secured relative to its token value. To put it simply, the protocol seems to be priced very conservatively when compared to the liquidity and activity it has already been supporting. Long-term observers would take this ratio as an indicator of strength rather than weakness.

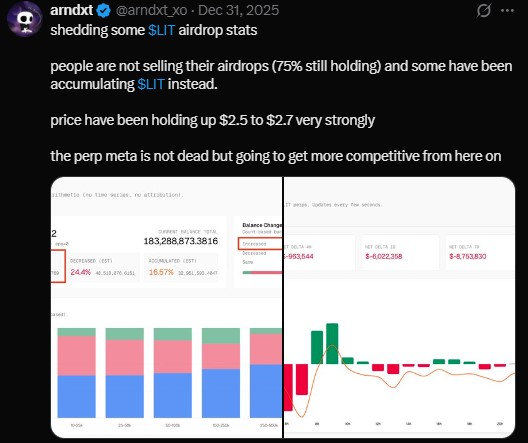

Among the various dangers connected with a token launch, the airdrop recipients' selling is at the top of the list. Nevertheless, Lighter indicates a different pattern. More than half of the airdrop recipients continue to keep the tokens, and some wallets are buying more actively rather than selling.

Such actions have resulted in diminishing immediate downside pressure and thus indicate the rising conviction of the market in LIT’s long-term potential.

The price movement gives credence to this opinion. LIT has consistently defended the $2.30–$2.50 range, a sign of strong demand from buyers who are ready to come in when the price dips.

The perpetual trading sector is getting more competitive, but it is still very vibrant. Projects that possess real liquidity, user retention, and consistent on-chain activity will be the ones that survive and even develop.

Lighter is a protocol that, due to its high TVL and holding behavior, can be compared to the well-positioned ones. This does not mean that the project will grow exponentially but rather it will be supported by the structure, particularly if the whole crypto sentiment changes for the better in 2026.

Analyzing the 15-minute chart, LIT has a very clear pattern:

A steep fall towards $2.30. Then during which consolidation and repeated shielding of $2.45–$2.50 occurs.

The whole pattern is akin to base-building, where the selling pressure is drained off and the volatility is compressed. RSI hovering around 50 implies the momentum to be neutral.

A prospect to reach $3.00 may open if $2.55–$2.60 is breached with volume. Not being able to hold the support may mean going back to test $2.35–$2.30. In summary, the setup continues to be in favor of either a range-bound or mildly bullish continuation as long as the critical support level is maintained.

In summary, the setup continues to be in favor of either a range-bound or mildly bullish continuation as long as the critical support level is maintained.

Bearish scenario: $2.30-$2.40 if support does not hold

Base case: $2.60-$2.90 with smooth adoption

Bullish scenario: $3.20+ if user growth and liquidity are further accelerated

It is likely that there will be fluctuations in the short run but the strong TVL of LIT, low selling pressure, and the presence of demand zones indicate that there may be price increases if the general market conditions are favorable.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Always do your own research.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.