The crypto market has once more turned bullish and that is why the investors are putting forward a very important question: Is Bitcoin ready for its next great rally in 2026, or is there a temporary retreat that still has to happen?

With Bitcoin's 17th birthday, strong technical signals, and better market mood, 2026 may turn out to be a year of great importance for BTC.

The worldwide market capitalization of cryptocurrencies went up 2.6%, reaching $3.16 trillion, which is an indication that the investors are willing to take more risks again. Bitcoin has reached the $90,000 mark again, while Ethereum is still over $3,000.

At the same time, XRP replaced BNB and thus taking the third place among the biggest cryptocurrencies indicates very strong capital switching in the crypto market—a feature that often precedes the broad bullish cycles.

Bitcoin has now completed 17 years from the mining of the Genesis Block, which was done by Satoshi Nakamoto and contained a hidden message that condemned bank bailouts. The core tenet of the crypto world—decentralization and financial freedom—still holds strong today.

Usually, BTC birthdays bring the market sentiment up. By 2026 this event could be a psychological factor that leads to the resumption of investor interest. This is especially true if that investor interest is reinforced by institutional adoption, ETF inflows, and the overall economic uncertainty.

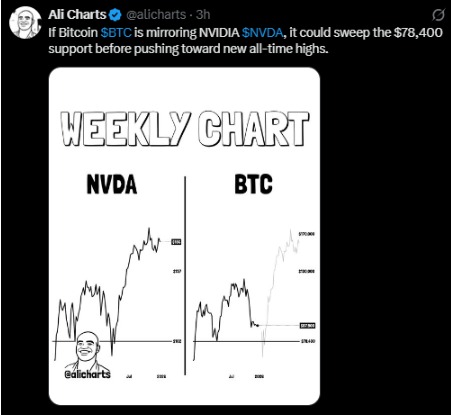

Crypto analyst Ali Charts points out that on the weekly chart, a certain resemblance between Bitcoin (BTC) and NVIDIA (NVDA) is very noticeable. If this is the case, then BTC may go through a temporary decline before eventually returning to its bullish trend.

In the event that this scenario takes place, The world’s largest cryptocurrency will likely be testing the $78,400 support area for liquidity quite unnoticeably. The soft-handed traders will be taken out of the market. Nevertheless, such corrections can strengthen the long-term uptrends rather than do the opposite.

Ali Charts also draws attention to a historical parallel from early 2022 when BTC price fell below the 50-week Simple Moving Average (50W SMA) and then retested it as resistance before plummeting.

A potential formation of a similar pattern is indicated. The uptrend of BTC towards $103,000 is envisaged in the short run but if the price does not manage to stay above the 50W SMA, a deeper correction—maybe to the $42,000 area—will most likely follow. Hence, the 50-week SMA is a crucial point to watch in 2026.

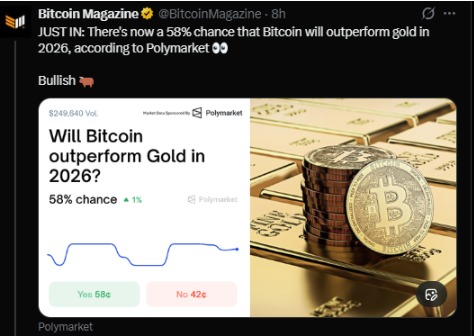

To back up the bullish prospects, Polymarket assigns a 58% chance to Bitcoin as the victor over gold in 2026. This increase in confidence regarding Bitcoin as a digital store of value can be attributed to factors like the huge popularity of the ETF, the inflow of institutional investment, and the uncertain global economy.

A comparison between Bitcoin and the classic safe-haven metal, the mood of the investors slot in more on BTC for a chance of greater long-term profits.

According to the analyst Ted Pillows, BTC is exhibiting early signs of a likely bullish reversal after breaking above a downward trendline that has held for a long time. The breakout, indicated on the daily chart, is taking place after weeks of price consolidating in a tightening triangle that is cutting off the selling pressure.

The confirmation of a daily close above the trendline is still being awaited but the move appears encouraging and potentially the initiation of the upside momentum to be bounced back if the buyers hold the territory.

Bullish Scenario

A strong close above $90,000 by Bitcoin would result in the acceleration of the momentum. A breakout confirmation with increasing volume might drive BTC to $120,000-$150,000 in 2026.

Bearish Scenario

On the other hand, $85,000 is still a support level of great importance. A breach underneath this could lead that in the opposite direction—down to $80,000-$78,000, corresponding with the major liquidity targets.

Disclaimer: As always, this is not financial advice. Investors should manage risk and monitor confirmation levels closely.

This article discusses price scenarios based on technical indicators, historical patterns, and current market data. All price levels, forecasts, and potential targets are speculative and may not materialize.

Cryptocurrency markets are highly volatile and can result in significant losses. Nothing in this content constitutes financial, investment, trading, or any other form of professional advice. Readers should conduct their own research, consider their financial situation and risk tolerance, and, if needed, consult a licensed financial advisor before making any investment decisions.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.