Key Highlights:

Bitcoin is dominating 56.4%; Fear and Greed Index is extreme fear (7).

Mixed price action. Select altcoins move up, with sentiment unfavorable.

Bitdeer Plans $300M Convertible Notes Offering

Overall Crypto Market Update, 20 February 2026: The cryptocurrency increased to reach a valuation of $2.38 trillion as Bitcoin increased by 1%, Ethereum dropped marginally, and the altcoins exhibited mixed momentum with extreme fear.

Source: Forex Factory

The global cryptocurrency market today reached a capitalization of $2.38 trillion, noted a slight 0.3% upward trend in the last 24 hours, whereas Total trading volume was recorded at $87.5 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 56.4%, while Ethereum (ETH) carries 9.92%. The largest gainers in the industry over the past day are Polkadot and XRP Ledger Ecosystem.

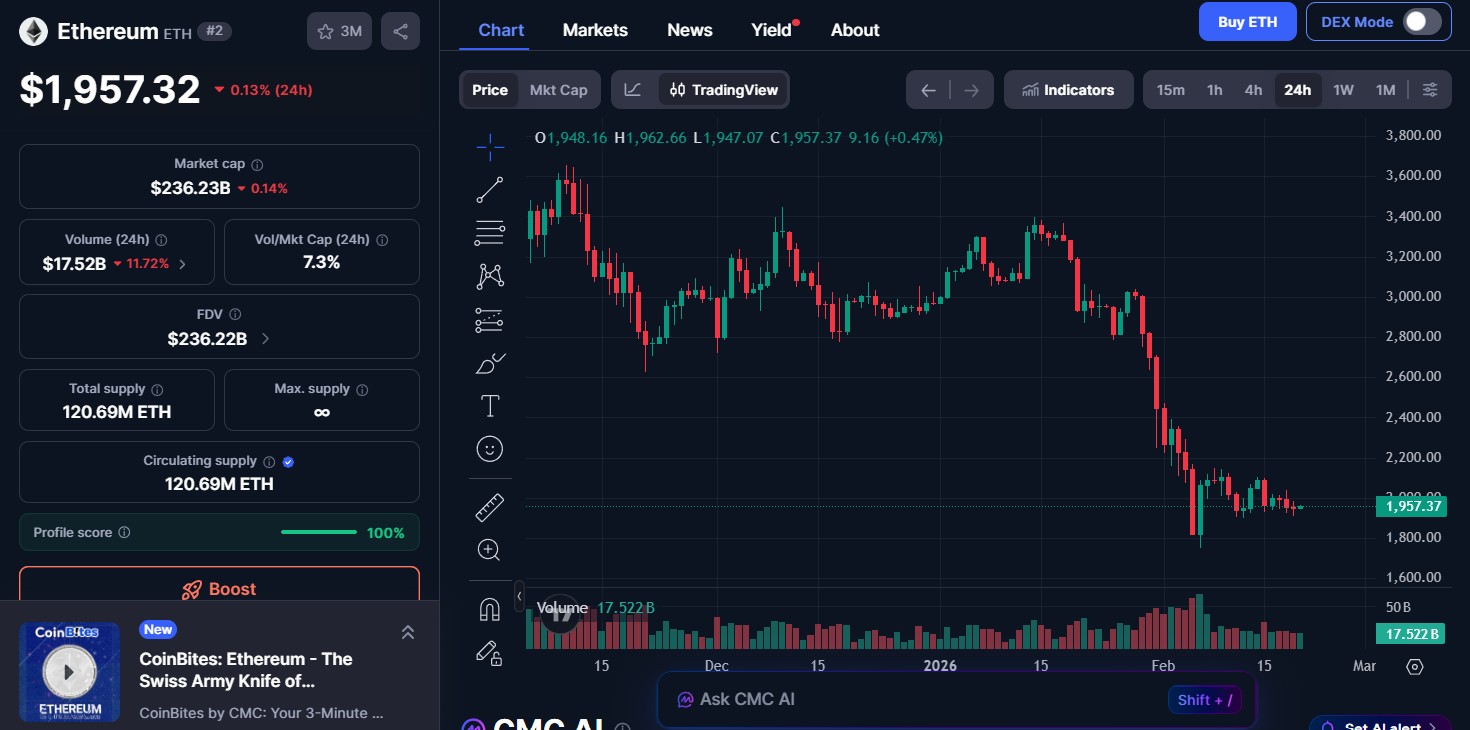

Bitcoin (BTC) and Ethereum (ETH) Price Analysis:

(Note: BTC and ETH are often viewed as less volatile historically, but still risky. The data recorded from CoinMarketCap)

Bitcoin (BTC) price today reached $67288.95, surged 1% in the last 24-H, with a trading volume of $31.7 billion and a market cap of $1.34 trillion.

Ethereum (ETH) price today is at $1957.32, a decrease with a minor 0.13% in 24-H with a trading volume of $17.5 billion and a market cap of $236.2 billion.

Top Trending Crypto Coins Price in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

XRP price (XRP): $1.41, slips 0.21% in the last 24 hours, trading volume (TV): $2.32B.

Enso price (ENSO): $1.71, surges 46.07% in the last 24 hours, TV: $217.46M.

RaveDAO price (RAVE): $0.4967, soars 29.35% in the last 24 hours, TV: $59.8M.

BNB price (BNB): $607.21, up 0.39% in the last 24 hours, TV: $1.44B.

Falcon Finance price (FF): $0.07942, dips 0.31% in the last 24 hours, TV: $83.13M.

Top 3 Crypto Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

Kite price today (KITE): $0.2542, jumped 13.41%, trading activity $132.94M.

Midnight price today (NIGHT): $0.06295, gained 9.44%, trading activity $24.65M.

Virtuals Protocol price today (VIRTUAL): $0.6437, rose 4.14%, trading activity $65.04M.

Top 3 Crypto Losers in 24 hours

(Ranked by 24-hour percentage loss)

Arbitrum price (ARB): $0.09678, down 9.87%, trading activity around $109.97 million.

Pi price (PI): $0.1763, losses 5.92%, with trading volume near $22.48 million.

MemeCore price (M): $1.34, dips 5.55%, trading activity close to $9.58 million.

Stablecoins and Defi Update:

Stablecoins reflects 0.1% positive change over the past 24 hours, with a market capitalization of $309.5 billion and trading volume of $67.5 billion.

The Overall (Defi) Decentralized Finance market escalated 0.5% over the last 24 hours, recording a market cap of $49.5 billion and trading volume (TV) at $3.5 billion. Defi dominance globally marked 2.1%.

Source: Alternative Me

Today’s Crypto Fear & Greed Index stands at 7, signaling extreme fear. Yesterday and last week were 9, while last month was 24. The decline reflects heavy selling, volatility, weak momentum, and risk-off sentiment driven by macro uncertainty and falling crypto prices.

(Note: All of these updates affect traders, as they impact liquidity, sentiment, and potential returns, and thus must be monitored closely.)

1. White House Backs Limited Stablecoin Rewards: The White House backs restricted stablecoin rewards in a structure bill, which will modify the GENIUS Act, and officials' crypto connections and agency vacancies are debated.

2. xStocks Exceeds $25B Trading: xStocks has surpassed $25 billion cumulative trading volume since June 2025, and is in the top 7 out of 24-hour tokenized stock positions, and opened its Chinese X account.

3. Bitdeer Plans $300M Convertible Notes Offering: Bitcoin miner Bitdeer will issue $300 million convertible senior notes due 2032 to finance data centers, HPC, AI cloud expansion, ASIC research, and buy back 2029 notes.

4. ether.fi Moves Cash to Optimism: ether.fi will transfer its Cash debit card to OP Mainnet, where Optimism will transfer 70,000 cards, 300,000 accounts, and $160 million TVL, and provide safe and uninterrupted services.

5. White House Has Stablecoin Yield Meeting: A third White House meeting on stablecoin yield will be held at 9 AM ET, and Coinbase, Ripple, and a16z representatives will be present in the discussion.

6. Wall Street Buys More Bitmine Shares: Morgan Stanley, ARK, and other major firms increased Bitmine holdings despite a 48% stock drop, as the company remains the largest corporate holder of Ethereum.

As compared to yesterday, the crypto market cap dips 1% While the today's posted a mild 0.3% gain. However, sentiment remains deeply fearful at index 7 compared to the past day 9. Bitcoin recovered today, but Ethereum still shows minor losses. Altcoins showed sharper percentage swings, indicating selective risk despite broader caution.

Cryptocurrency users have a weak yet promising future. High volatility can be an indication of undervaluation to long-term investors, but also extreme fear. Before deciding on short-term investment or leveraged investment decisions, traders must pay close attention to liquidity, macro developments, and Bitcoin dominance.

Risk Context: This commentary is not about long-term conditions and is merely informational. It does not point in the direction of the price or show an action to be taken on the investment.

Based on the 24-hour update, investment remains risky due to extreme fear and mixed momentum. However, selective opportunities exist in strong-performing assets. Cautious accumulation with proper risk management may benefit disciplined investors rather than aggressive short-term speculation.

Disclaimer: This content is for informational purposes only and does not constitute financial or investment advice. Cryptocurrency markets are highly volatile and risky. Always conduct your own research and consult a qualified financial advisor before making investment decisions. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.