XRP is once again under pressure as broader crypto market weakness and US regulatory delays drag prices lower. After recently touching $2.41, the token has dropped back to around $1.90, leaving investors asking one big question: Is this just a temporary pullback, or is XRP quietly setting up for a massive breakout?

Despite short-term weakness, on-chain data, exchange activity, and long-term technical structures are fueling fresh speculation that a much larger move could be ahead. Let’s break it all down in simple terms.

The recent decline comes as traders react to regulatory uncertainty in the United States. The US Senate Agriculture Committee postponed its markup vote on the Market Structure Bill following a similar delay by the Senate Banking Committee.

These delays have weakened investor confidence across crypto markets, limiting fresh buying interest. When regulations remain unclear, traders often reduce exposure, leading to short-term price drops.

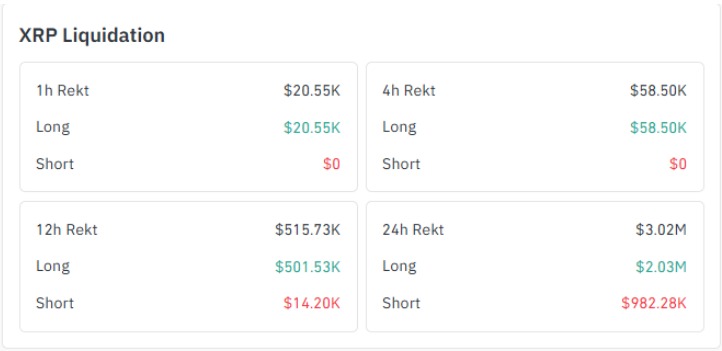

According to Coinglass , over the last 24 hours, Ripple recorded $3.02 million in liquidations, with long positions suffering the most. Around $2.03 million in long trades were wiped out, while short liquidations stood near $982,000.

This imbalance shows that bullish traders expected a rebound too early. As a result, the altcoin lost momentum and slipped below key support levels near $2.

While price action looks weak, fundamentals are not entirely negative. Binance, the world’s largest crypto exchange, confirmed it will list Ripple’s US dollar stablecoin for spot trading.

Ripple CEO Brad Garlinghouse called the development “eXtremely Positive,” signaling strong confidence in Ripple’s expanding ecosystem. Although this news did not trigger an immediate price rally, it supports the long-term utility and adoption narrative.

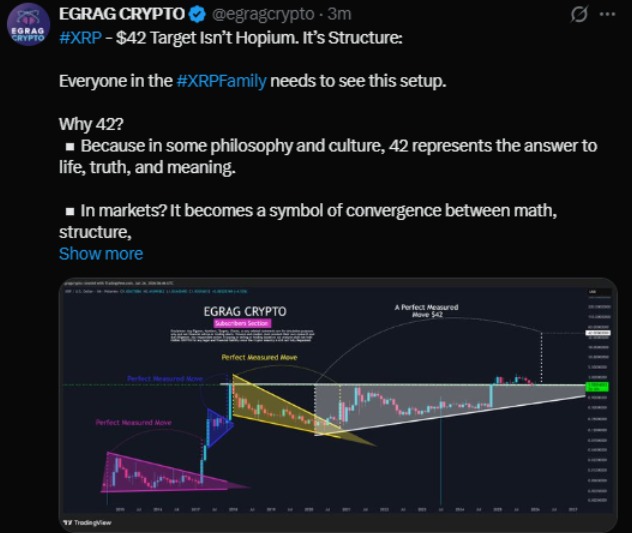

Popular analyst EGRAG CRYPTO believes the long-term setup deserves attention. According to his analysis, the altcoin has followed three historical macro price structures, each respecting measured moves with near-perfect precision.

Now, the altcoin appears to be forming a fourth similar structure, showing the same compression, breakout logic, time symmetry, and expansion behavior. This suggests a cyclical pattern, not random price action.

In the near term, the token may remain volatile as long as regulatory uncertainty and market-wide weakness persist. If selling pressure continues, it could retest support around $1.75–$1.80.

However, a recovery above $2.10 could restore bullish momentum and open the door toward $2.40–$2.60 in the short run.

EGRAG CRYPTO’s $42 XRP target is not guaranteed, but it is technically grounded in historical price behavior. If the altcoin confirms a long-term breakout and market conditions turn favorable, the structure allows for a powerful expansion phase.

Still, investors should understand that such targets depend on time, adoption growth, and regulatory clarity. The structure provides a pathway, not a promise.

Disclaimer: The content on this page is for informational and educational purposes only and does not constitute financial, investment, or trading advice. Cryptocurrency investments are highly volatile and involve significant risk.

Always conduct your own research (DYOR) and consult with a licensed financial advisor before making any investment decisions. The authors and publishers are not responsible for any profits, losses, or damages arising from your use of this information.

Lokesh Gupta is a seasoned financial expert with 23 years of experience in Forex, Comex, NSE, MCX, NCDEX, and cryptocurrency markets. Investors have trusted his technical analysis skills so they may negotiate market swings and make wise investment selections. Lokesh merges his deep understanding of the market with his enthusiasm for teaching in his role as Content & Research Lead, producing informative pieces that give investors a leg up. In both conventional and cryptocurrency markets, he is a reliable adviser because of his strategic direction and ability to examine intricate market movements. Dedicated to study, market analysis, and investor education, Lokesh keeps abreast of the always-changing financial scene. His accurate and well-researched observations provide traders and investors with the tools they need to thrive in ever-changing market conditions.