Is the next major crypto forming quietly underneath global macro turbulence? The past week saw an aggressive rise in global liquidity, driven by China, the U.S. Federal Reserve, and the U.S. Treasury – a rare alignment that historically fuels strong upside for Bitcoin and altcoins.

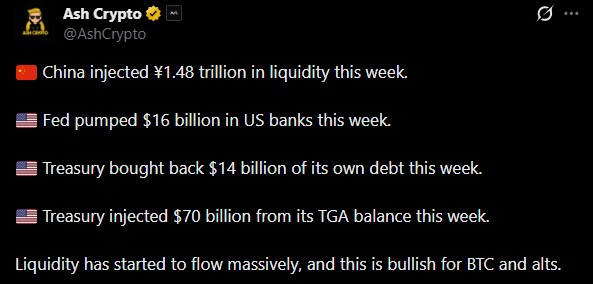

Source: AshCrypto

While BTC’s price dipped amid regulatory caution and institutional hedging, broader cash inflows now signal a powerful long-term catalyst building in the background.

The world’s largest economies injected a combined trillions in capital, easing financial conditions and strengthening risk-on assets.

China injected ¥1.48 trillion (around $209 USD) through its MLF operations, treasury trading, cash management, and reverse repo activities. Even though the reverse-repo cycle recorded a net withdrawal,the overall market flows footprint grew significantly.

At the same time, the U.S. Federal Reserve added $13.5 billion into the banking system in its second-largest repo operation since the COVID-19 crisis. More importantly, the Fed officially ended Quantitative Tightening on December 1 after draining $2.4 trillion since 2022, a major policy shift towards easier monetary expansion conditions.

Adding to the global liquidity surge, the U.S. Treasury conducted the largest debt buyback in American history, repurchasing $14.5 billion in a single week while injecting an additional $70 billion from its TGA account. Such moves are designed to stabilise funding conditions but also ripple outward into broader around the globe markets.

Together these steps reflect a clear shift toward expanding Global Liquidity, a macro signal that typically strengthens demand for risk assets– but how? Let’s understand.

Because crypto is one of the most liquidity-sensitive asset classes, these macro injections generally strengthen its long-term trajectory, even if short-term volatility persists.

More liquidity = More capital flowing into risk assets such as Bitcoin and altcoins as seen in 2013, 2017, and 2020–21 cycles.

Lower funding stress encourages institutions to re-enter high-beta assets.

End of Quantitative Tightening (QT) removes a major capital drain, typically marking the beginning of multi-year crypto bull cycles.

Debt buybacks and repo injections lower borrowing costs, indirectly improving crypto market depth.

Despite the cash inflows surge, Bitcoin fell 2.05% to $89,537 within 24 hours, while the broader market dipped nearly 2.09%. The decline came from a combination of technical and regulatory pressures:

China’s securities regulator (CSRC) tightened crypto risk monitoring, triggering risk-off flows.

A major institutional strategy moved $1.44B into cash, signalling hedging ahead of market volatility.

BTC slipped below key moving averages ($90.5K–$93.6K), activating automated sell orders.

Talking about the broader altcoin market, the CMC Altcoin Season Index remains at 21/100, signalling that Bitcoin still dominates capital inflows. Once BTC stabilises under expanding global liquidity, capital typically rotates into altcoins, often sparking a stronger altcoin season.

The simultaneous monetary expansion across China, the Federal reserve, and the U.S. Treasury indicates a shift toward easier financial conditions worldwide. Historically, periods of rising Liquidity support major rallies in Bitcoin and strong altcoin market expansion.

As monetary conditions ease and worldwide cash supply grows, crypto markets – especially Bitcoin, tend to experience:

Higher institutional inflows

Increased trading volumes

Stronger risk appetite

Improved market supply and price support

Although short-term volatility persists due to regulatory shocks, technical triggers, and institutional hedging, the underlying macro picture looks progressively bullish.

Bhumika Baghel is a rising crypto content writer with a deepening interest in blockchain technology and digital finance. With a keen understanding of market trends and cryptocurrency ecosystems, she breaks down intricate subjects like Bitcoin, altcoins, DeFi, and NFTs into accessible and engaging content. Bhumika blends well-researched insights with a clear, concise writing style that resonates with both newcomers and experienced crypto enthusiasts. Committed to tracking price fluctuations, new project developments, and regulatory shifts, she ensures her readers stay informed in the fast-moving world of crypto. Bhumika is a strong advocate of blockchain’s potential to drive innovation and promote financial inclusion on a global scale.