Overall Crypto Market Update:

The global cryptocurrency market cap stands at $3.17 trillion, reflecting a 0.5% increase in the past 24 hours.

Total crypto 24-hour trading volume is $115.6 billion.

Bitcoin dominates 56.9% of the market, while Ethereum holds 11.9%.

As per CoinGecko, it is currently tracking 19,215 cryptocurrencies.

The largest gainers right now are tokens from the Polkadot and XRP Ledger Ecosystems.

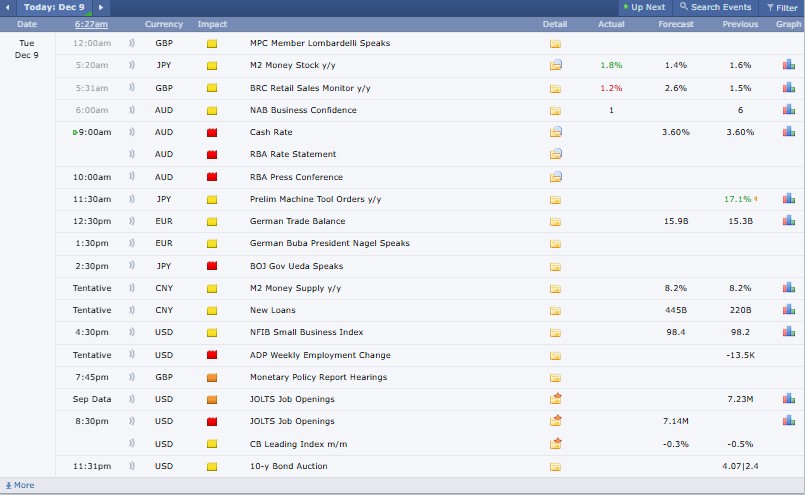

Source: Forex Factory

Bitcoin (BTC) and Ethereum (ETH) Price:

Bitcoin (BTC) is trading at $90420, up 0.03% in the last 24 hours, with a trading volume of $56 billion and a market cap of $1.80 trillion.

Ethereum (ETH) is priced at $3121.73, rising 1.86% in 24 hours with a trading volume of $24.8 billion and a market cap of $376.5 billion.

Top 5 Trending Coins in 24 Hours:

SkaInet (SKAI) is trading at $0.00006885 after a massive 644.96% surge in the last 24 hours, with $67.72K in trading volume.

Bitcoin (BTC) stands at $90,374.10, showing a slight 0.01% dip over 24 hours and recording $56.45B in volume.

Yooldo Esports (ESPORTS) is priced at $0.4102, up 3.94% in the past day with a strong $209.47M trading volume.

Ethereum (ETH) trades at $3,116.56, rising 1.67% over 24 hours and seeing $24.84B in volume.

Zcash (ZEC) is at $415.54, jumping 20.49% in a day with $1.31B in trading volume.

Top 3 Gainers in 24 hours

Canton (CC) is trading at $0.07591, posting a strong 20.99% gain, with a trading activity of $32.48 million, making it one of today’s top movers.

Zcash (ZEC) stands at $414.13, up 20.02%, supported by a heavy $1.31 billion trading activity that reflects strong market activity.

Dash (DASH) is priced at $49.35, rising 9.17% with a $216.62 million trading activity.

Top 3 Losers in 24 hours

DoubleZero (2Z) is priced at $0.1296, down 8.84%, with a trading volume of about $50.3 million.

Bitcoin Cash (BCH) trades at $580.53, falling 2.87%, and recorded a trading volume of roughly $330.3 million.

TRON (TRX) is valued at $0.2804, slipping 2.43%, with a trading volume of $542.2 million.

Stablecoins and Defi Update:

Stablecoins recorded a 0.1% negative change in the past 24 hours, with a market cap of $312.5 billion and trading volume of $89 billion.

The Decentralized Finance (DeFi) market rose 1.6% in the last 24 hours, reaching a market cap of $112 billion, while total value locked (TVL) stands at $5 billion.

Source: Alternative Me

Cryptocurrency Fear & Greed Index reads 22 — Extreme Fear, showing traders are highly cautious. This usually happens when markets face recent price drops, low trading activity, or uncertainty about upcoming economic events, leading investors to avoid risk and wait for clearer direction.

1. CFTC Launches New Digital-Asset Collateral Program

Acting CFTC (Commodity Futures Trading Commission) Chair Caroline Pham introduced a pilot allowing BTC (Bitcoin), ETH (Ethereum), and USDC (fiat-backed stablecoin) as derivatives collateral. The agency also issued new tokenized-collateral guidance and withdrew outdated Staff Advisory 20-34.

2. Coinbase Announces New Token Listings for December 2025

Coinbase will list Plume and Jupiter for spot trading on December 9, 2025, pending liquidity. It also added Theoriq to its listing roadmap, highlighting growing support for RWA (Real World Asset), DeFi, and AI-focused projects.

3. MicroBT Unveils Ultra-Efficient WhatsMiner M70 Series

MicroBT launched its WhatsMiner M70 series in Abu Dhabi, delivering efficiency as low as 12.5 J/TH. The lineup spans 214 TH/s to 1 PH/s models, with HashSmith joining as a mining partner.

4. BlackRock Files for Staked Ethereum ETF

BlackRock has officially filed for a staked Ethereum ETF (Exchange Traded Fund), taking its first major step toward SEC (Securities Exchange Commission) approval. The firm already holds $11B in ETH, and the new ETF aims to provide separate staking exposure.

5. Paradigm Leads Crown’s $13.5M Round

Paradigm has made its first Brazil investment, leading a $13.5 million Series A in Crown, the issuer of BRLV, a real-pegged stablecoin backed by government bonds, valuing the firm at $90 million.

6. UK FCA to Simplify Investment Rules for Retail Investors

The UK’s FCA (Financial Conduct Authority) plans major investment rule changes, replacing the Key Information Document with a simpler product summary and creating clearer retail–professional categories to ease access and offer more flexibility for wealthy clients.

7. BitMine Boosts Its Ethereum Holdings

BitMine Immersion Technologies revealed it now holds 3,864,951 ETH after adding 138,452 ETH this week. The company also owns 193 BTC, $1 billion cash, and $36 million in equity, totaling $13.2 billion in assets.

8. WEEX Opens AI Trading Strategy Hackathon

WEEX has launched an AI Trading Strategy Hackathon for individuals and teams, testing models in real-market conditions with a focus on market analysis, high-frequency data, risk control, and extreme-volatility performance.

9. Strategy Boosts Bitcoin Holdings to 660,624 BTC After New $962M Purchase

Strategy has bought 10,624 BTC for $962.7M at $90,615 each, pushing its total holdings to 660,624 BTC worth $49.35B, with a strong 24.7% BTC yield in 2025.

10. SEC Ends Probe Into Ondo Finance

The SEC has closed its two-year investigation into Ondo Finance, deciding not to pursue charges after reviewing its tokenized Treasury products and ONDO token. Ondo received official confirmation in late November.

The industry shows extreme fear, signalling high caution among investors, despite selective gains in major tokens and strong institutional activity. Volatility remains elevated, making short-term investments risky. However, blue-chip assets like BTC, ETH, and regulated products appear less volatile. Investors should adopt a slow, selective, and research-driven approach in the current environment.

Disclaimer: This is not financial advice. Please DYOR before investing. CoinGabbar is not responsible for any financial losses. Crypto assets are highly volatile and you can lose your entire investment.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.