Key Highlights:

The crypto market cap increased to $3.08T with Bitcoin and Ethereum recording consistent gains amidst a fearful mood.

Meme coins and some altcoins were the greatest gainers, while Hyperliquid, Canton, and Monero were among the notable losers.

The market mood has improved slightly, but macroeconomic risks and security issues persist.

Overall Crypto Market Update, 2 January 2025: The cryptocurrency sphere was recovering moderately with increased capitalization and volumes, inconsistent performances of the altcoins, cautiousness, and significant advances in regulation, security, and exchange policies.

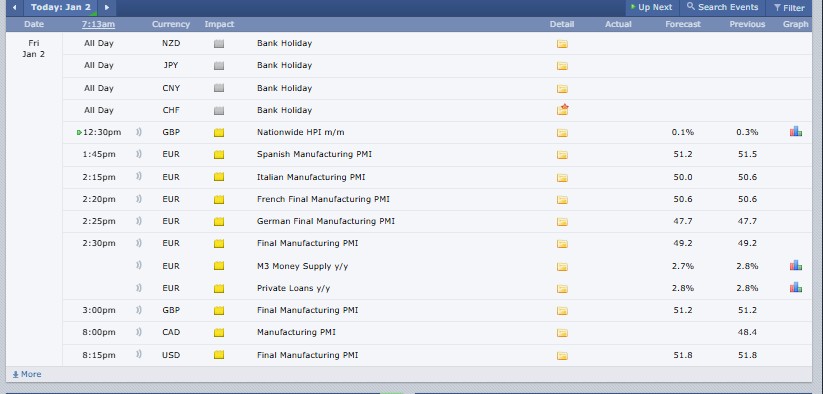

Source: Forex Factory

The global cryptocurrency market today recorded a capitalization of $3.08 trillion, reflecting a 0.9% positive change in the last 24 hours. Total trading volume noted $64 billion.

Bitcoin’s (BTC) dominance over the industry remains intense, with 57.3%, while Ethereum (ETH) carries 11.7%. As of now, 19980 cryptocurrencies are being tracked. The largest gainers of the industry are Polkadot and XRP Ledger Ecosystem in the last 24 hours.

Bitcoin (BTC) and Ethereum (ETH) Price:

Note: BTC and ETH are often viewed as less volatile historically, but still risky.

Bitcoin (BTC) price today reached $88603.49, rose by 0.96% in the last 24 hours, with a trading volume of $19.24 billion and a market cap of $1.76 trillion.

Ethereum (ETH) priced today sits at $2998.51, slightly up 0.69% in 24 hours, with a trading volume of $10.33 billion and a market cap of $361.98 billion.

Top 5 Trending Coins in 24 Hours:

(Trending data is based on a combination of 24-hour price movement, trading volume, and CoinMarketCap.com trending metrics.)

Pepe (PEPE) is trading at $0.054941, rising 22.3%, alongside a trading volume (TV) of $579.87M.

Starpower (STAR) is valued at $0.1186, up 2.99%, with $473.32M traded.

Dogecoin (DOGE) is trading at $0.1266, gaining 7.28%, with a massive trading activity of $1.31B.

Falcon Finance (FF) is priced at $0.09000, up 4.71%, recording $112.35M in TV.

Filecoin (FIL) is trading at $1.48, rising 14.46%, with a TV of $295.79M.

Top 3 Gainers in 24 hours:

(Ranked by 24-hour percentage gain)

Pepe (PEPE) at $0.054948, up 22.43%, with a strong trading activity of $579.13 million.

Story (IP) at $2.03, gaining 20.35%, supported by TV of $203.51 million

Aerodrome Finance (AERO) is at $0.4738, rising 17.04%, with a TV of $43.82 million.

Top 3 Losers in 24 hours

(Ranked by 24-hour percentage loss)

Hyperliquid (HYPE) at $24.44, down 5.49%, with a strong trading volume of $218.6 million.

Canton (CC) at $0.1522, declining 5.03%, while posting a trading activity of $71.6 million.

Monero (XMR) at $415.46, falling 3.43%, with daily trading volume close to $53.7 million..

Stablecoins and Defi Update:

Stablecoins noted a 0.1% negative change over the past 24 hours, with a market capitalization of $310.8 billion and trading volume of $46.6 billion.

The Decentralized Finance (DeFi) market surged 2.1% over the last 24 hours, recording a market cap of $105 billion and total value locked (TVL) at $3.35 billion. Defi dominance globally marked 3.4%.

(TVL refers to the total crypto assets locked in DeFi protocols.)

Source: Alternative Me

The current Fear and Greed Index is 28 (Fear), compared to 20 (Extreme Fear) on both the previous day and last week. This increase is an indication of weak sentiment recovery, probably due to the temporary stabilization of prices. Nevertheless, the macro uncertainty and poor volumes remain constant to keep the fear prevailing. Compared to last month’s 28, sentiment remains unchanged overall.

(Note: All of these updates affect traders, as they affect liquidity, sentiment, and potential returns, and thus have to be monitored closely.)

1. Iran Considers Crypto Payments for Arms Sales

Iran’s defence export agency Mindex proposed accepting cryptocurrency for selling missiles, drones, and warships, alongside barter and rial payments, claiming arms clients across 35 countries.

2. Lighter Airdrop Allocation, Jump Crypto Role

Lighter clarified its airdrop points are mostly non-trading, with under 10% tied to partners, while reports confirm Jump Crypto market-making received 0.93% of LIT supply during the early platform development phase.

3. Hyperliquid Reaffirms Neutral Token Launch

Hyperliquid (HYPE) founder Jeff said the platform prioritizes integrity and neutrality, with no private investors, no market maker privileges, zero protocol fees, and genesis tokens allocated to early users, verifiable on-chain.

4. Hundreds of EVM Wallets Quietly Drained

ZachXBT monitoring shows hundreds of EVM wallets are being quietly drained, each losing under $2,000, with an unknown cause, totaling $107,000 so far and rising across multiple chains globally.

5. Dormant HYPE Whale Moves Millions

A dormant entity unstaked 631,900 HYPE worth $20.3M via three wallets in three days, 14–15% holdings, bought post-TGE using Tornado Cash funds after over a year idle.

6. Coinbase CEO Defends Product Strategy

Coinbase CEO Brian Armstrong said Coinbase matches Robinhood’s retail features, plans futures trading, stock integration, broader crypto support, and positions Base App as an independent social trading experiment.

Compared to yesterday’s extreme fear, today’s sentiment shows slight improvement as prices stabilize. Nevertheless, volumes are average, and profits are selective, compared to last month when the mood and involvement were also reserved.

Cryptocurrency users are advised to anticipate volatile movements within a short period of time, with selective opportunities in trending coins. Although the market is becoming more stable, there are security threats, whale migration, and political issues to consider. It is still necessary to monitor volume, dominance, and sentiment indicators to make informed decisions.

Risk Context: This commentary is only informational and not for long-term conditions. It does not indicate the direction of the price or indicate an action to be taken on the investment.

The industry that is available is moderately good but risky. Volatility in trending assets can be an advantage for short-term traders, whereas long-term investors need to be careful. The sentiment of fear, security threats, and macro uncertainty implies that disciplined risk management and selective exposure are important.

Disclaimer: This is not financial advice. Do Your Own Research before investing. CoinGabbar is not liable for any financial loss. The crypto assets are risky, and you may lose all your investments. Not all regions can offer some of the services or assets discussed.

Sakshi Jain is a crypto journalist with over 3 years of experience in industry research, financial analysis, and content creation. She specializes in producing insightful blogs, in-depth news coverage, and SEO-optimized content. Passionate about bringing clarity and engagement to the fast-changing world of cryptocurrencies, Sakshi focuses on delivering accurate and timely insights. As a crypto journalist at Coin Gabbar, she researches and analyzes market trends, reports on the latest crypto developments and regulations, and crafts high-quality content on emerging blockchain technologies.